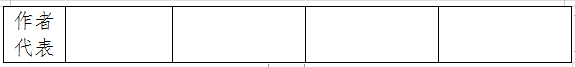

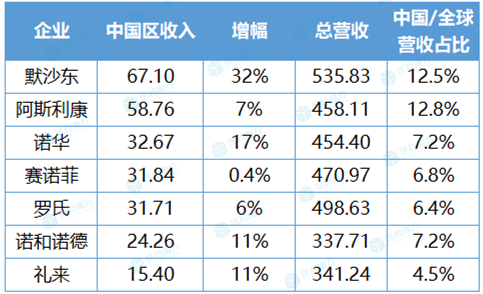

In 2023, the pharmaceutical market in China is changing rapidly. MNC also deeply felt this radical change, and rewrote their scripts one after another, each adapting to the rules of the China market with a more flexible strategy and an open attitude. The final performance confirmed the effectiveness of these changes, and the income of seven MNCs in China district increased uniformly. Merck won with a revenue of 6.71 billion US dollars, and Novartis, Novo Nordisk and Lilly all achieved double-digit growth. In terms of proportion, AstraZeneca is still the MNC with the highest proportion of global revenue in China.

Revenue and proportion of seven MNCs in China in 2023 (USD 100 million)

Note: 1) The revenues of Merck and Roche only include pharmaceutical business; 2) Average exchange rate in 2023: 1 euro =1.0935 USD, 1 Swiss franc =1.1177 USD, 1 Danish kroner =0.1454 USD; 3) The increase is calculated at the fixed exchange rate (CER)

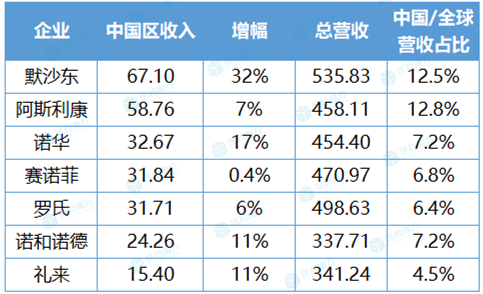

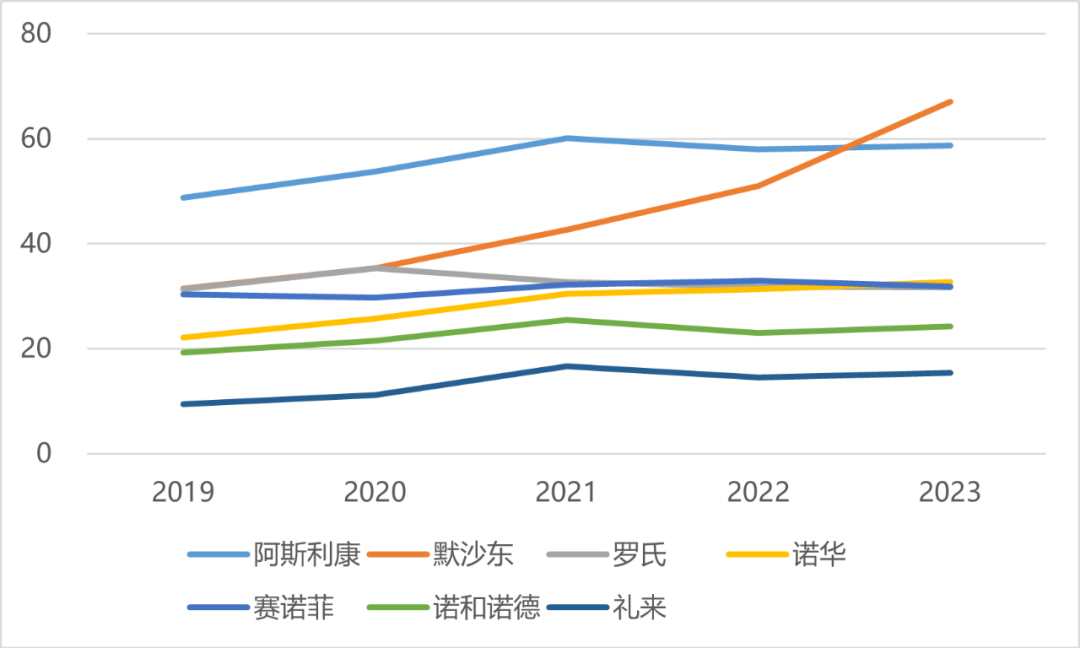

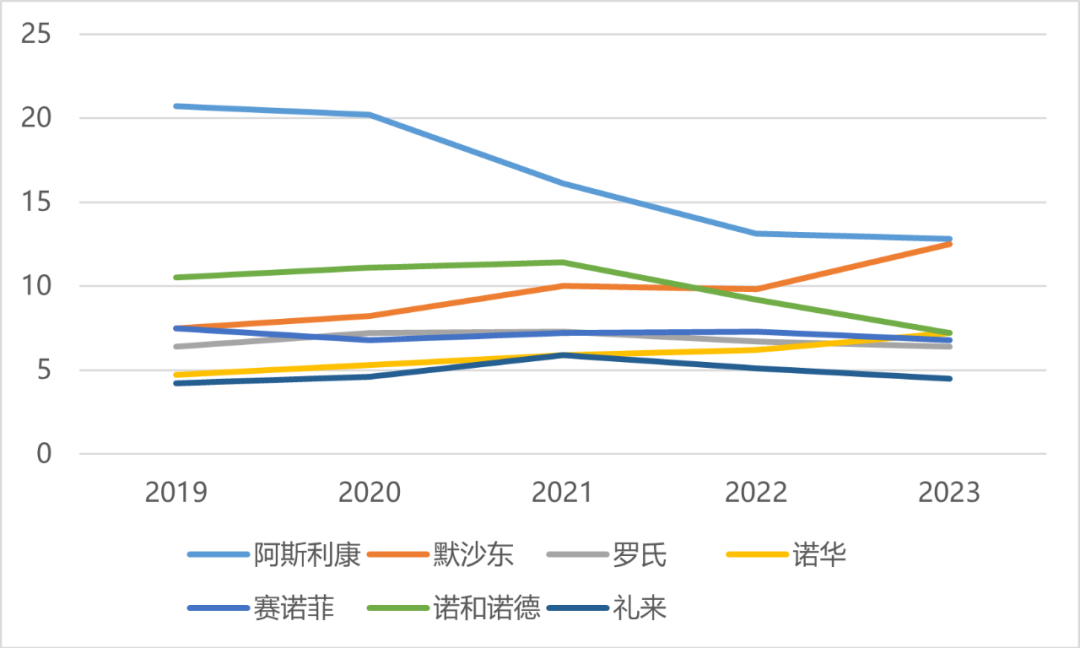

Looking at the timeline, an indisputable fact is emerging — — Although the China performance of the above pharmaceutical giants all increased in 2023, except Merck, the growth momentum of most players is not so rapid.

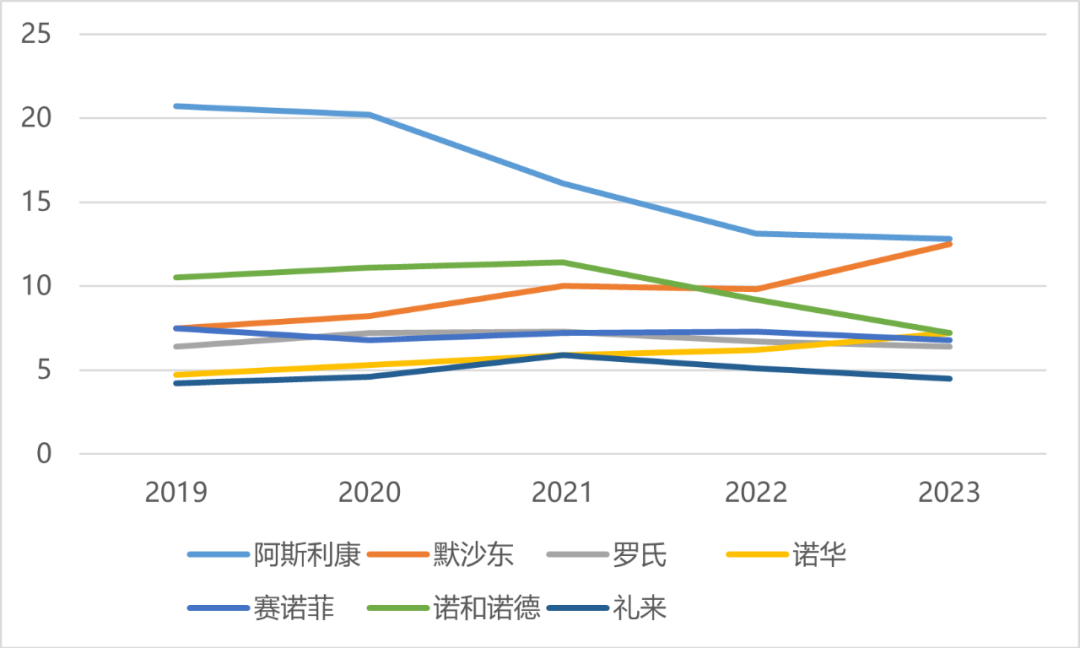

Revenue of 7 MNCs in China from 2019 to 2023 (USD 100 million)

In the past five years, the bonus of AstraZeneca’s performance in China to its global revenue has also weakened, as has Novo Nordisk; The proportion of Merck’s performance in China showed an upward trend, while the proportion of income in other MNCs in China stabilized at 5-10%.

Revenue proportion of seven MNCs in China from 2019 to 2023 (%)

Correspondingly, in the face of the ups and downs of the industry, pharmaceutical giants have to constantly adjust their development models in China, and find a path that is more suitable for them and the local market. As a result, the organizational structure and business lines have changed to varying degrees, and the integration and reconstruction are bound to go through a painful period.

At the same time, with the iterative evolution of China’s innovation ecosystem, the positioning of multinational pharmaceutical companies in China is also changing. In their eyes, China has become not only a key consumer market, but also an important source of innovation. On the one hand, the giants step by step deepen the global synchronous R&D strategy, and strive for the new drug "zero time difference" to land in China, and even China; On the other hand, through BD, equity investment and even wholly-owned acquisition, they constantly absorb China’s innovation, thus empowering global innovation.

Products are the foundation of our existence.

The report card handed over by Merck is particularly shining. Its pharmaceutical business income was US$ 53.583 billion, and China contributed US$ 6.71 billion, accounting for 12.5% of the total, up 32% year-on-year, making it the best-performing multinational pharmaceutical company in China in 2023.

Merck won this honor without the help of the king fried product Gardasil/Gardail9, an HPV vaccine. The global sales of Gardasil/Gardail9 products have reached 8.886 billion US dollars, and the growth rate is also high, reaching 29%. Merck mentioned that this was especially due to the strong demand in China.

According to the database of Medical Rubik’s Cube, there are five types of HPV vaccines approved for marketing in China, namely Gardasil(4 valence, 2014) and Gardail9(9 valence, 2018) of Merck, Cervarix(2 valence, 2016) of GSK, Xinkening (2 valence, 2019) of Wan Tai Bio and Wozehui (2 valence, 2019) of Zerun Bio.

After Gardail9 was expanded from 16-26 years old to 9-45 years old, domestic vaccine companies have felt the intimidation of Merck. Recently, Wan Tai Bio released a pre-reduction announcement for its performance in 2023, indicating that its revenue from bivalent cervical cancer vaccine decreased by about 4.2 billion yuan year-on-year due to factors such as the aging of 9-valent cervical cancer vaccine.

Gardail9 was also approved by China National Medical Products Administration (NMPA) in January, 2024, adding a two-dose vaccination program for women aged 9-14. The vaccination cost of Gardail9 in Merck in major public hospitals in China is 1331 yuan/needle. Compared with 3 needles, 2 needles vaccination is undoubtedly a more economical and convenient choice for the audience, which reduces its vaccination cost and is also conducive to Merck’s speeding up the domestic HPV vaccine market.

Robert M. Davis, head of Merck, said that there is a huge market for HPV vaccine in China, and it is estimated that there are still about 120-130 million urban women who meet the vaccination conditions. In addition, most local competitors enter the last-tier cities, and the target population is different from them. Therefore, he thinks that Gardasil/Gardail9 will still achieve long-term growth in the China market in the future. However, a variable that can not be ignored is that a number of domestic 9-valent HPV vaccines have entered the phase III clinical stage, or will join the market battle in the next year.

Although AstraZeneca lost to Merck in the performance competition, it is still the MNC with the highest proportion of global revenue in China, and AstraZeneca also has the largest number of new drugs approved in China in 2023, including Enhertu (de trastuzumab), Calquence (acotinib), Koselugo (Smetinib), Xigduo XR (Dapagliflozin metformin tablets) and Beyfort.

Enhertu is an alpine lighthouse of ADC circuit and a subversive in the field of breast cancer. AstraZeneca has high hopes for it. In 2023, Enhertu successively obtained two major indications for advanced breast cancer with HER2 positive and low expression in China. AstraZeneca said in the financial report that the demand of Enhertu in China has grown strongly after the approval of these two indications. Globally, Enhertu has made great strides, doubling its annual sales to 343.8 billion yen (about 2.456 billion US dollars).

Focusing on China, Novartis has set a clear goal — — Achieve market TOP3. In the latest layout strategy, Novartis has elevated China to a priority development area at the same level as the United States, Germany and Japan. Naturally, the decision was made because of the continuous growth performance. The revenue of Novartis China increased from $2.214 billion in 2019 to $3.267 billion in 2023, and its share in global revenue also increased from 4.7% to 7.2%.

Novartis’s facade as Entresto (Shakuba Quvalsartan Sodium) achieved a global sales breakthrough, with annual sales exceeding $6 billion. In China, Novartis has also opened up a market of Entresto, and its increase in 2023 will mainly benefit from the increase in permeability in the fields of heart failure and hypertension. It is worth noting that Entresto’s core patent in China will expire in 2026. Fang Shenghe/Fosun’s Shakubatroxobin Sodium Tablets have successfully entered the market by breaking through the original patent barrier through innovative crystal forms.

The rising star Leqvio (Inkslan) is stepping up its offensive efforts and stabilizing Novartis’s position in the cardiovascular field. This new lipid-lowering siRNA has been approved in 94 countries, including China (August 2023), and its global sales increased by 217% to $355 million compared with last year. Novartis revealed in its annual report that Leqvio achieved early steady growth in China’s self-funded market.

Sanofi’s performance in China increased by 19% year-on-year to 644 million euros in 2023Q4, and its annual revenue was 2.912 billion euros (about 3.184 billion US dollars). In Q4, the strong growth of China district was attributed to Dupixent. In fact, it is not only the most powerful performance pillar of Sanofi, with a global sales of 10.715 billion euros (about 11.717 billion US dollars), but also the basis for it to attack the throne of the "immune giant".

In China, Dupixent has covered many indications such as moderate and severe atopic dermatitis, moderate and severe prurigo nodosa in adults, asthma in adolescents and adults aged 12 and over. The breakthrough is still going on, and Sanofi has submitted to NPMA an application for marketing Dupixent as a new indication for chronic obstructive pulmonary disease (COPD).

Roche’s product lines in China are mainly diversified. Polivy (vibotezumab), Tecentriq (atilizumab), Perjeta (pertuzumab), Kadcyla (Emetizumab) and Evrysdi have made their way out of the fierce market competition, and their sales in China have all increased in 2023. Tamiflu (oseltamivir) and Xofluza (mabaloxavir) sold well during the high incidence of influenza.

In the story of China, Roche has been continuously exporting innovative achievements. In November, 2023, Columvi was approved in China, opening a new era of double antibody therapy for China’s lymphoma. In December, Roche welcomed the approval of Vabysmo, bringing the first dual-channel treatment drug to millions of patients with fundus diseases in China.

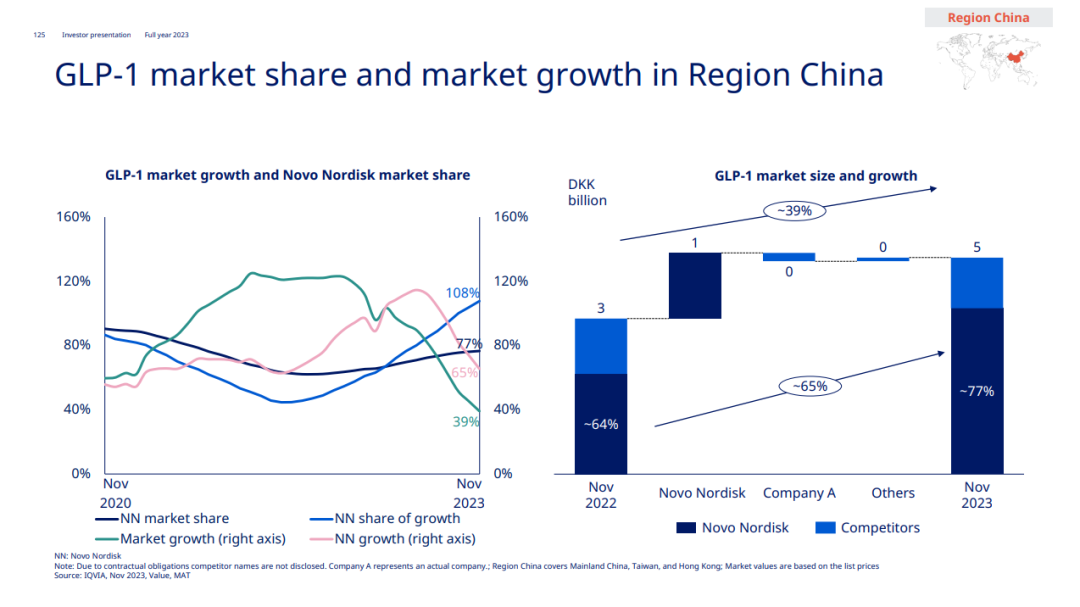

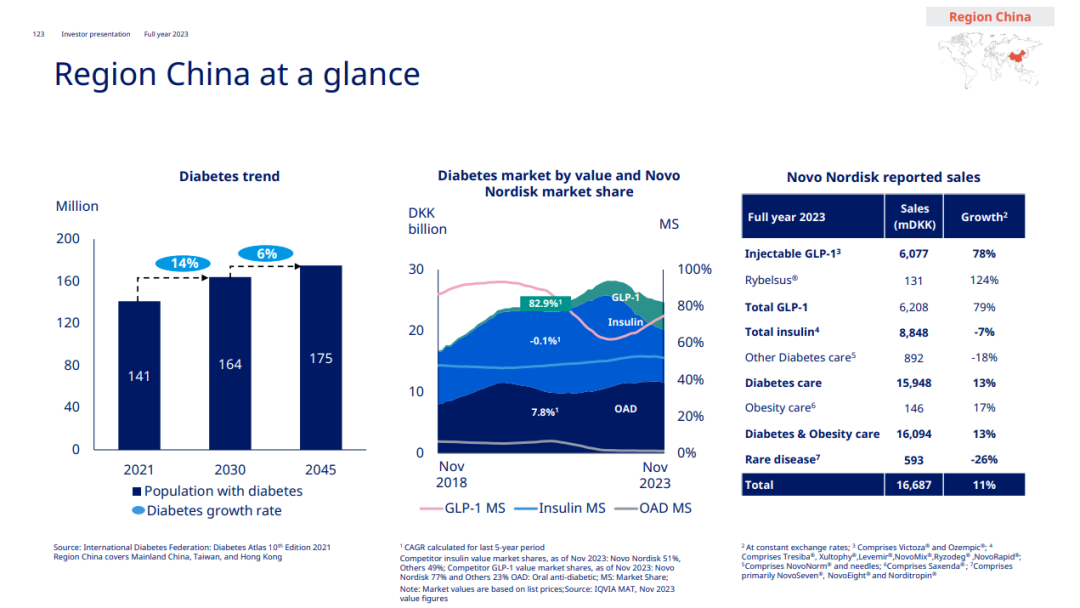

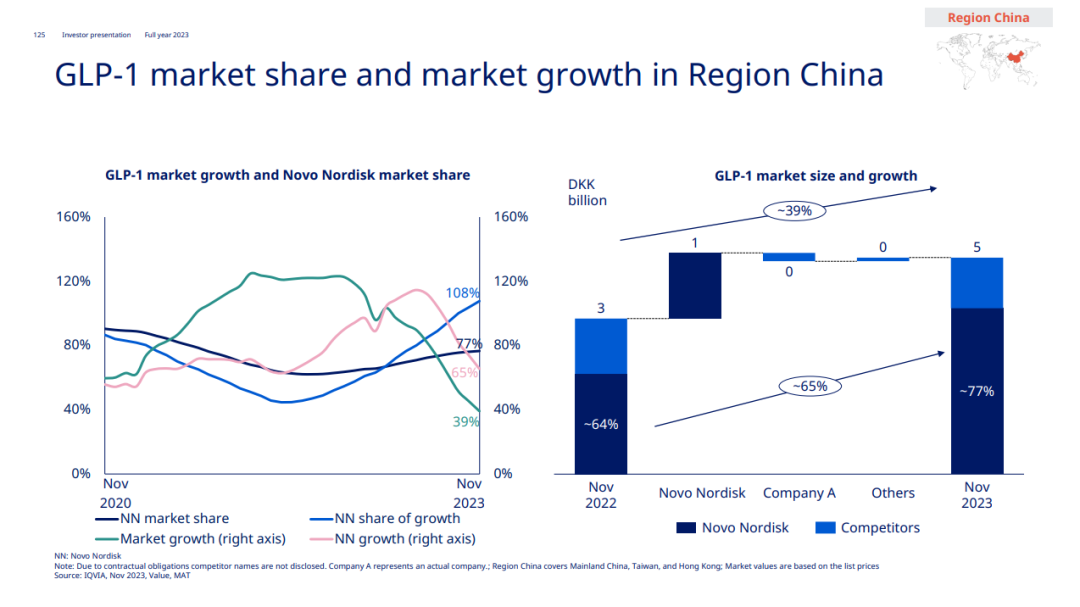

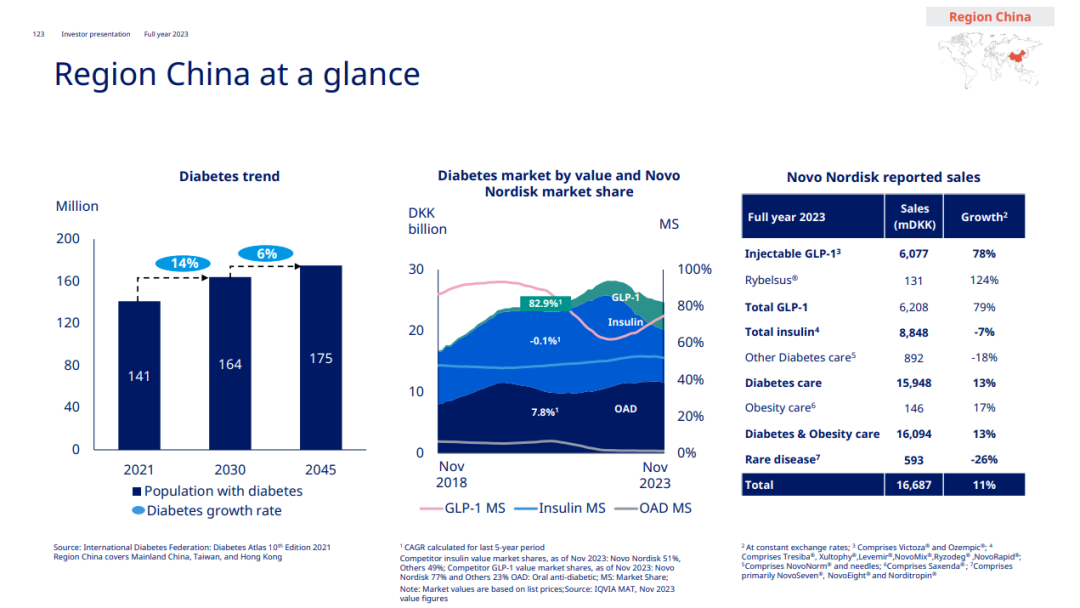

Novo Nordisk’s Smeagol peptide fully explains how big items can be beaten. The sales volume of smegliptide subcutaneous injection preparation (Ozempic, Novotai) in China has reached 4.821 billion Danish kroner (1 Danish kroner = 1.0246 yuan, about 4.940 billion yuan). Less than two years after its listing in China, Ozempic’s market competitiveness is amazing, and it has a crushing advantage over similar products.

With the addition of Ozempic, the revenue of Novo Nordisk’s GLP-1 products in China increased by 79% year-on-year to 6.208 billion Danish kroner (about 6.361 billion RMB), which swallowed up 77% of the GLP-1 market in China. It can also be inferred from this data that as of November 2023, the domestic GLP-1 market scale has exceeded 8 billion yuan.

The domestic sales of Novo Nordisk’s insulin products declined to 8.848 billion Danish kroner (about 9.066 billion yuan) due to the volume purchase, but it still occupied 40% of the market. Overall, the total income of diabetes business in China is 15.948 billion Danish kroner (about 6.361 billion RMB), accounting for 32% of the diabetes market in China.

Recently, Novo Nordisk has added another general to its product lineup in China. Smeagol tablets (Rybelsus, Novo and Xin) have been approved for marketing. As the only oral GLP-1 product, Rybelsus may further boost Novo Nordisk’s performance in China.

Lilly is not to be outdone. Telpotide is now released at a speed far exceeding that of Smegrupeptide in the same period. In 2023, the second year after the listing of Telpotide, its global sales reached 5.163 billion dollars. Holding such a heavyweight product, Lilly also hopes to enter the China market with unlimited potential, and its indications for reducing blood sugar and weight have been accepted by NMPA.

In the field of hair loss and Alzheimer’s Harmo’s disease (AD), Lilly made various plans and got stuck early. Baritinib is the first and only innovative targeted drug used in the systematic treatment of severe alopecia areata in China. Donanemab, a new drug for AD, was declared to be listed in China in October, 2023. The next generation of N3pG amyloid antibody remternetug has also been recognized as a breakthrough therapy for AD by NMPA, which is expected in the future.

Change reshapes the future.

With the iterative evolution of China’s innovation ecosystem, more and more pharmaceutical giants are attracted by the rising local innovation, and they all come for gold. Moreover, these giants seem to prefer to bet on early innovation at this stage compared with later assets with higher certainty.

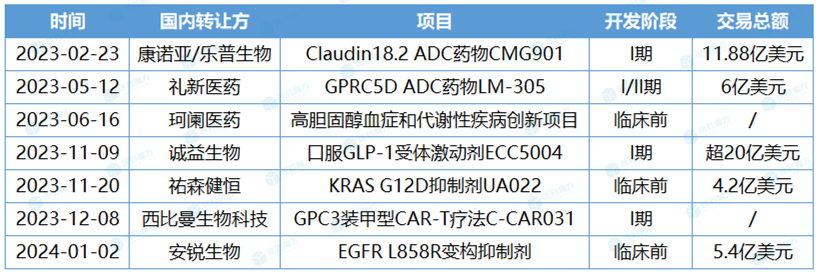

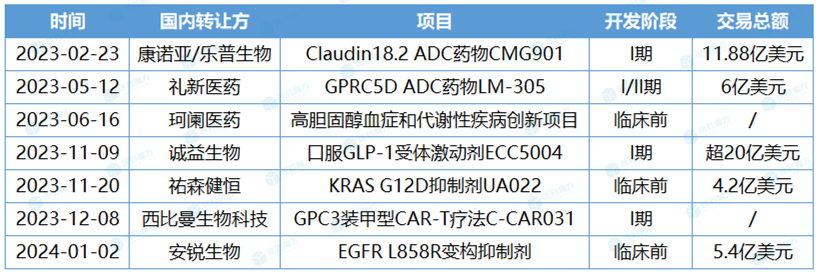

AstraZeneca is open-minded, unique in vision and firmly optimistic about local innovation. In the CAR-T year, it has successively placed bets on Claudin18.2 ADC drug CMG901 of Connoa/Lepu Bio, GPRC5D ADC drug LM-305 EGFR L858R Pharmaceutical, hypercholesterolemia and metabolic diseases innovation project of Kelan Pharmaceutical, oral GLP-1 receptor agonist ECC5004 of Chengyi Bio, KRAS G12D inhibitor UA022 of You Sen Jianheng, and new GPC3 armor type of Sibiman Biotechnology. These cooperative projects have one thing in common, almost all of them are in preclinical or phase I clinical stage.

China project introduced by AstraZeneca in the past year.

Among them, Kelan Medicine and Sibiman Biotechnology are also participating enterprises of AstraZeneca Zhongjin Medical Fund, which was jointly established by AstraZeneca and Zhongjin Capital in 2021. Through industrial fund investment, AstraZeneca hopes to bring more resources and opportunities to partners in the innovation ecosystem.

Not only that, AstraZeneca also acquired Genxi Bio for $1.2 billion. This groundbreaking and historic transaction marks the beginning of MNC’s complete acquisition of China Biotech, which not only represents another important exploration of AstraZeneca’s development strategy in China, but also plays a leading role in other MNC’s business models in China, and also opens a new path for China Biotech to exit gracefully.

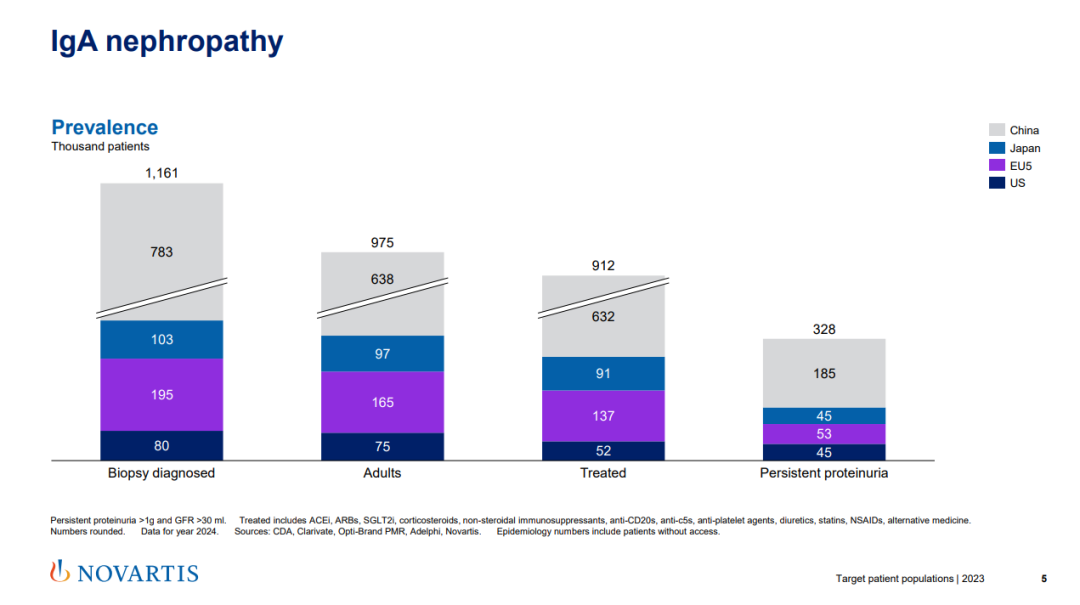

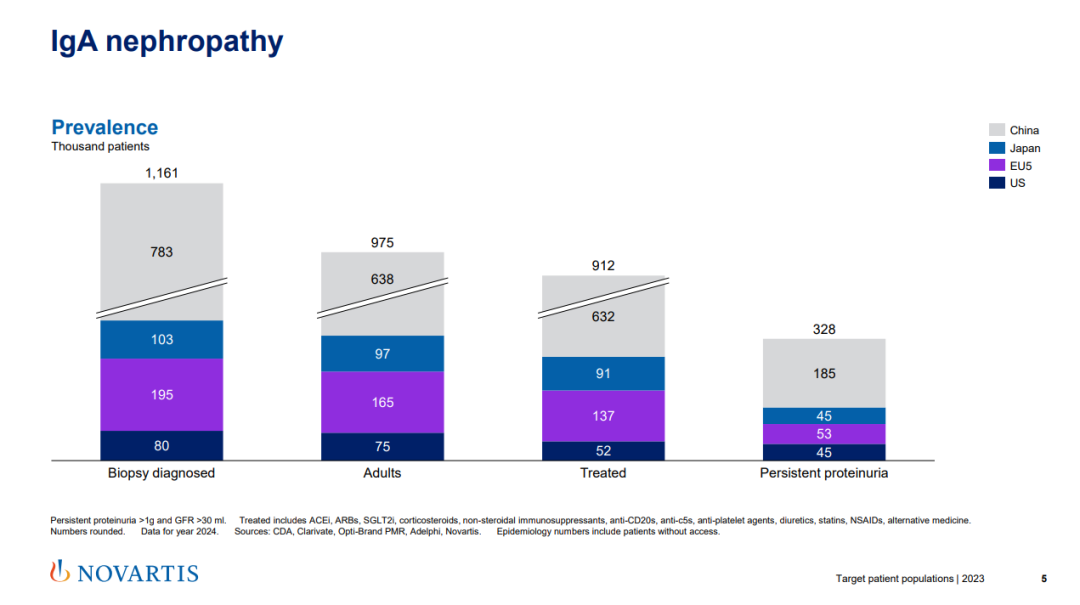

After AstraZeneca, Novartis also acquired a China Biotech— — Sinopharm, which owns the exclusive rights and interests of atrasentan and zigakibart, two innovative drugs for immunoglobulin A nephropathy (IgAN) in China and Singapore. Novartis’s intention to acquire Sinopharm is simple and clear, that is, to strengthen its competitiveness in the field of nephrology. This transaction also highlights China’s huge market potential in the global nephrology field.

After turning to a purely innovative drug company, Novartis redefined the layout of four core areas, namely cardiovascular-renal-metabolism, immunology, neuroscience and oncology, highlighting the important position in the field of renal metabolism. China has a wide range of patients with kidney disease, especially IgAN patients, who are mainly concentrated in China. I believe Novartis will definitely aim at the kidney disease market in China.

At the cutting-edge technology track, Novartis also noticed the potential of local innovative pharmaceutical companies. With a total value of US$ 4.165 billion, Novartis pocketed a number of new siRNA drugs from Bowang Pharmaceutical, and expanded its cardiovascular pipeline.

Novartis also acquired the global rights of legendary creature LB2102 for US$ 1.11 billion, and this DLL3 CAR-T therapy is conducting phase I research in patients with small cell lung cancer (SCLC) and pulmonary neuroendocrine tumors.

Novartis is a well-deserved pioneer in CAR-T circuit. It launched Kymriah, the world’s first CAR-T therapy, in 2017, but the first halo did not bring it a considerable sales increase. In 2023, Kymriah’s sales fell to about $500 million. If LB2102 successfully develops the differentiated indications of SCLC, then Novartis will undoubtedly seize a potential blockbuster.

Roche and China pharmaceutical companies "hand in hand" many times. In May, 2023, Roche acquired the global rights and interests of Zanrong Medicine’s oral small molecule HER2 inhibitor ZN-A-1041 with an advance payment of 70 million US dollars, a milestone amount of 610 million US dollars and a certain proportion of sales share price, and it is currently in the phase I clinical stage.

Although Roche has a variety of product combinations of HER2 monoclonal antibody and ADC, the existence of Enhertu has shaken its dominance in the field of breast cancer, and the supplement of this small molecule may bring new treatment schemes to patients with HER2 positive breast cancer, especially those with brain metastasis.

In January 2024, Roche and Yilian Bio reached a cooperation of over $1 billion on a preclinical c-MET ADC drug YL211. In fact, in addition to AstraZeneca, Roche, GSK, BMS, Merck and Merck mentioned above, MNCs have started domestic ADC.

On the one hand, MNC is eager to find high-value innovations and make plans for the next round of performance growth; On the other hand, under the background of industry cycle, they are also facing unprecedented pressure, and reducing costs and increasing efficiency have become their unified key words. The changes in China District occur from time to time. Many MNCs entrust local partners with the commercialization of some product lines, and organizational restructuring is also common.

Merck can win TOP1 in China this year, and there is also a contribution from Zhifei Bio behind it. Since 2011, Merck has entrusted Zhifei Bio with the marketing of vaccine products. In January 2023, the two sides renewed cooperation on five vaccine products, including HPV vaccine and pentavalent rotavirus vaccine.

Later, GSK and Pfizer also realized that it seems to be a more efficient choice to hand over the vaccine to local enterprises, and decided Zhifei Bio and Keyuan Xinhai as partners respectively. After all, in China, vaccine sales need to be distributed through a series of channels to reach the end users, which requires the sinking sales ability of enterprises.

Also changing is Sanofi. In September, 2023, Sanofi updated its organizational structure in China and directly established three new global management positions: President of Sanofi Greater China, Head of R&D in China and Head of Manufacturing and Supply Chain in China. The signals released by these personnel changes are obvious, and the China market has become more and more important in the global map of Sanofi.

In October, Sanofi made a major adjustment in the overall strategy of the company and entered a new chapter of "Play to Win" strategy. The specific measures included launching a strategic cost plan and redistributing most of the saved funds to innovation and growth drivers.

In the China market, Sanofi is also moving in this direction. In December, Sanofi and Shanghai Pharmaceutical Holdings announced omni-channel cooperation in key disease areas, which is one of the largest, widest and deepest strategic cooperation between pharmaceutical industry and commerce in recent years. With the help of commercialization, Sanofi can devote more resources to innovation and development, which flexibly balances "innovation and efficiency".

Similarly, Roche and Novartis have upgraded their cooperation with Sinopharm Holdings to speed up the market access of products and further expand the local medical and health ecosystem.

Frequent personnel changes and business restructuring are also surging in MNC. President Novartis China has taken up his new post, and Zhang Ying has succeeded Bednian. Lilly changed coaches more frequently in China. After serving as president and general manager of Lilly China for more than a year, Bei Jingming left her post. Her successor was Huzur Devletsah, who was also the first female head of Lilly China. AstraZeneca China District set up China biopharmaceutical business, which was headed by Lin Xiao. After Pfizer China abolished the vaccine line, it welcomed Wang Yu &hellip, general manager of Oncology Division; …

summary

Although the performance competition of MNC China in 2023 has come to an end, a new round of competition has begun, and perhaps next year’s ranking is another scene. The situation changes, and the competition never stops. The only thing that is certain is that the integration of MNC and China market has become more and more deep and inseparable in the constant reshuffle and change.