South Capital Center of Jinzhengyan-Interpretation of Financial Report Yunye/Author Ying Wei/Risk Control

At present, the discount integration of snack industry is accelerating, and the scale effect is gradually emerging. Looking back on the listing of Liangpin Shop Co., Ltd., a well-known snack manufacturer (hereinafter referred to as "Liangpin Shop"), on February 24, 2020, Liangpin Shop was successfully listed at an issue price of 11.9 yuan/share. On July 15th of the same year, the share price of Liangpin Store reached its peak, which was 85.22 yuan/share. As of January 11th, 2024, the closing price was 19.81 yuan/share, and the share price of Liangpin Store showed a downward trend.

Just one year after listing, the first round of reduction plan was implemented just after the lifting of the ban on the shares of the promoters of Liangpin Store, and 456 million yuan was cashed out. During this reduction period, the share price of Liangpin Store went down, and Liangpin Store bought back shares on bargain hunting to implement the employee stock ownership plan. Since then, its shareholders have frequently reduced their holdings, and there are also real controllers in the ranks of reduction. During the period when relevant shareholders reduce their holdings, the total market value of good shops may evaporate by tens of billions of yuan.

It is worth mentioning that Liangpin Shop claims to expand its business by investing in snack-selling "track" companies. However, in only half a year, it sold all the underlying shares and gained an investment income of about 60 million yuan. In the first three quarters of 2023, the performance of good shops grew negatively year-on-year. In addition, the good shop boasts itself as "the first share of high-end snacks", but its gross profit margin is not as good as that of its peers. On the other hand, the draft employee stock ownership plan of Liangpin Store was hastily revised one day after it was published. The stock price of employees was adjusted from 9.9 yuan to 16.7 yuan per share, and the share payment fee was reduced by more than 20 million yuan.

First, Gaolin Capital, which has just been released from the market for one year, reduced its holdings in the first round and cashed in 456 million yuan. During this period, the good shops bought back shares on bargain hunting.

According to public information, on February 24, 2020, the good shop was officially listed on the main board of the Shanghai Stock Exchange.

It is worth noting that just one year after Liangpin Store landed in the capital market, its shareholders holding more than 5% of shares "threw out" the first round of reduction plan.

On February 27th, 2021, Liangpin Store issued the Announcement of Shareholder’s Shareholding Reduction Plan. The shareholders of Liangpin Store are Zhuhai Gaoying Tianda Equity Investment Management Center (Limited Partnership) (hereinafter referred to as "Zhuhai Gaoying"), HH LPPZ(HK)Holdings Limited (hereinafter referred to as "Hong Kong Gaoying") and Ningbo Gaoying Zhi. These shares are all derived from the shares held by Liangpin Store before its IPO.

According to the Announcement of Shareholder’s Shareholding Reduction Results signed by Liangpin Store on August 28th, 2021, due to their own capital needs, Zhuhai Gaoyou, Hong Kong Gaoyou and Ningbo Gaoyou (hereinafter collectively referred to as "Gaoyou Capital") plan to start from March 2021.The total number of shares of the good shop reduced by centralized bidding from February 22nd to August 26th, 2021 and by block trading or agreement transfer from March 4th, 2021 to August 26th, 2021 shall not exceed 24,060,000 shares, which shall not exceed 6% of the total share capital.

As of August 26th, 2021, when the planned reduction time expired, the shareholder Gao Ying Capital reduced its holdings of 10,776,494 shares of Liangpin Store by means of block trading and centralized bidding, accounting for 2.69% of the total share capital.

The announcement shows thatThe reduction price of Gaoyan Capital this time is 33.07-53.19 yuan/share., reducing the total amount by 456 million yuan.

After the implementation of this reduction plan, Gaoling Capital holds 36,023,777 shares of Liangpin Store, accounting for 8.98% of the total share capital of Liangpin Store at present.

From the time point of view, on February 27, 2021, Liangpin Store announced the first round of shareholding reduction plan of shareholder Gaoying Capital. At this time, Liangpin Store has just been listed for one year, and Gaochun Capital, as a shareholder holding more than 5%, has just lifted the ban.

During the period of Gaochun Capital’s reduction, the stock price of Liangpin Store fluctuated and fell.

According to the data of Oriental Fortune Choice, from February 27th, 2021, the announcement date of Gaoyan Capital Reduction Plan to August 26th, 2021, the stock price of Liangpin Store reached the highest value of 61.71 yuan/share on March 2nd, 2021, and the closing price on that day was 60 yuan/share, and the lowest value was 31.63 yuan/share on July 28th, 2021.

By July, 2021, the first reduction plan of shareholder Gaoyan Capital entered the "end". Compared with the date of the announcement of the reduction plan, the share price of Liangpin Store was close to "waist cut", and at this time Liangpin Store announced the share repurchase plan.

According to the Announcement on Share Repurchase by Centralized Bidding signed by Liangpin Store on July 7, 2021, Liangpin Store held the sixth meeting of the second board of directors and the sixth meeting of the second board of supervisors on July 6, 2021, and reviewed and approved the Proposal on Share Repurchase by Centralized Bidding, agreeing that the company should use its own funds not less than 75 million yuan and not more than 150 million yuan. Buy back the company’s shares by centralized competitive bidding, the repurchase price shall not exceed 69.85 yuan/share (including 69.85 yuan/share), and the repurchase period shall be within 6 months from the date when the board of directors deliberated and passed the share repurchase plan.

The purpose of repurchase is to implement the equity incentive plan or employee stock ownership plan.

According to the Announcement on the Expiration of Share Repurchase Term and the Results of Repurchase Implementation signed by Liangpin Store on January 6, 2022, as of January 5, 2022, Liangpin Store has repurchased 3,016,600 shares through centralized bidding, accounting for 0.75% of the total share capital of Liangpin Store. The highest price purchased is 35 yuan/share, and the lowest price is 31.35 yuan/share.

That is, from July 6, 2021 to January 5, 2022, the share repurchase price of the good shop was 31.35-35 yuan/share.

Compared with the first reduction price range of shareholder Gaoyan Capital, the stock repurchase price of good shops may be at a low level.

Second, the market value of Gao Lin and Dayong evaporated by more than 10 billion yuan during the busy period of reducing their holdings, and the actual controller also "mixed in" after the lifting of the ban.

As mentioned above, just one year after the listing of Liangpin Store, Gaochun Capital, as a shareholder holding more than 5%, reduced its holdings and cashed in 456 million yuan. In fact, since then, Gaochun Capital has continued to reduce its holdings. Not only that, the second largest shareholder and actual controller of Liangpin Store also took turns to reduce their holdings.

On August 26, 2021, Gaochun Capital completed the first reduction plan for good shops. Less than two months later, Gaochun Capital "stepped into" the second round of reduction plan.

According to the Announcement on the Results of Shareholder’s Shareholding Reduction signed by Liangpin Store on April 9, 2022, due to its own capital needs, Gaoyan Capital plans to reduce its shareholding in Liangpin Store by centralized bidding from October 29, 2021 to April 7, 2022, and by block trading or agreement transfer from October 13, 2021 to April 7, 2022, with a total amount of no more than 24,060,000.

As of April 7, 2022, when the planned reduction time expired, the shareholder Gao Ying Capital reduced its holdings of 5,911,800 shares of Liangpin Store through block trading, accounting for 1.47% of the total share capital of Liangpin Store.

During this reduction, the reduction price of Gaochun Capital was 40-40.81 yuan/share, with a total reduction of 239 million yuan.

After the implementation of this reduction plan, Gaoling Capital holds 30,111,977 shares of Liangpin Store, accounting for 7.51% of the total share capital of Liangpin Store.

Soon, the good shop ushered in the third round of reduction of Gaochun Capital.

According to the Announcement on the Change of Shareholders’ Equity by More than 5% and the Result of Shareholding Reduction signed by Liangpin Store on November 19, 2022, due to its own capital needs, Gaoling Capital plans to reduce the shares of Liangpin Store by centralized bidding from June 14, 2022 to November 20, 2022, and by block trading or agreement transfer from May 26, 2022 to November 20, 2022.

As of November 18, 2022, upon the expiration of this reduction plan, shareholder Gao Ying Capital reduced its holdings of 7,821,956 shares of Liangpin Store by centralized bidding, accounting for 1.95% of the total share capital.

The price of this reduction is 25.47-35.64 yuan/share, with a total reduction of 219 million yuan.

After this equity change, Gaoling Capital holds 22,290,021 shares of Liangpin Shop, accounting for 5.56% of the total share capital.

The reduction is still going on.

According to the Announcement on the Change of Shareholders’ Equity Holding More than 5% and the Result of Shareholding Reduction signed by Liangpin Store on May 20, 2023, from March 14, 2023 to May 19, 2023, Gaoling Capital reduced its shareholding in Liangpin Store by 2,240,021 shares, accounting for 0.56% of the total share capital.

The price of this reduction is 299.3-39.14 yuan/share, with a total reduction of 73.1651 million yuan.

After this equity change, Gaoling Capital holds 20,050,000 shares of Liangpin Store, accounting for 5% of the total share capital of Liangpin Store.

According to the Announcement of Shareholder’s Centralized Bidding and Shareholding Reduction Plan signed by Liangpin Store on June 3, 2023, according to the fund term requirements, the total number of shares of Liangpin Store to be reduced by centralized bidding from June 28, 2023 to September 25, 2023 shall not exceed 4,010,000 shares, which shall not exceed 1% of the total share capital of Liangpin Store. In any continuous 90 days, the total number of shares reduced by centralized bidding transaction shall not exceed 1% of the total number of shares in good shops.

According to the Announcement on the Results of Holding Shares by Centralized Bidding signed by Liangpin Store on October 20, 2023, from June 28, 2023 to September 25, 2023, Gaoling Capital accumulated 4,009,356 shares of Liangpin Store through centralized bidding, accounting for 0.9998% of the total share capital of Liangpin Store.

The price of this reduction is 23.30-26.38 yuan/share, with a total reduction of 99.8484 million yuan.

After this equity change, the proportion of Gaoling Capital holding shares in Liangpin Store is 4.0002%.

As of the inquiry date, January 10th, 2024, Gaochun Capital has no new trend of reducing its holdings.

Looking back on history, Liangpin Store disclosed in the prospectus signed on January 21, 2020 (hereinafter referred to as "the prospectus signed on January 21, 2020") that with the rapid growth of Liangpin Store’s performance and the continuous improvement of brand awareness, investors continued to be optimistic about the future development prospects of Liangpin Store, so in 2017, Liangpin Store received a capital increase of RMB 326,049,500 from shareholders.

Just in 2017, the good shop completed the share reform.

According to the prospectus signed on January 21, 2020, Liangpin Store completed the share reform in December 2017, and was one of the founders of Gaochun Capital.

In other words, Gaochun Capital, as the initiator of share reform, was originally optimistic about the development prospects of good shops. After the lifting of the ban on its shares, it implemented five reduction plans in a row, and even the upper limit of the "card" reduction ratio for the fifth time, reducing the shareholding ratio to less than 5%. This also means that if Gaochun Capital still has a reduction plan, the good shop will not need to make an announcement in advance.

During the period of gaoling capital reduction, the second largest shareholder of Liangpin Store also joined the ranks of reduction.

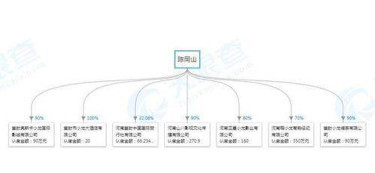

According to the 2022 annual report of Liangpin Store, by the end of 2022, Dayong Co., Ltd. (hereinafter referred to as Dayong Co., Ltd.) held 121,496,526 shares of Liangpin Store, accounting for 30.3% of the total share capital, making it the second largest shareholder.

According to the Announcement of Shareholder’s Equity Change by 1% and Early Termination of Shareholding Reduction Plan signed by Liangpin Shop on December 2, 2023, Liangpin Shop disclosed the Announcement of Shareholder’s Shareholding Reduction Plan on May 18, 2023. Due to its own capital requirements, Dayong Co., Ltd. plans to reduce the total number of shares in Liangpin Store by centralized bidding or block trading to no more than 24,060,000 shares, which is no more than 6% of the total share capital. The reduction period of Dayong Limited through centralized bidding transaction is within 6 months after 15 trading days from the date of announcement of the reduction plan; The reduction period by block trading is within 6 months after 3 trading days from the date of announcement of the reduction plan.

From May 25, 2023 to November 29, 2023, Dayong Limited reduced its holdings by 17,040,000 shares through centralized bidding and block trading, accounting for 4.25% of the total share capital.

The price of this reduction is 19.46-28.53 yuan/share, and the total amount of reduction is 404 million yuan. After the reduction, Dayong Limited holds 26.05% of the shares.

In addition, the original concerted action of the good shop also participated in the reduction.

According to the 2022 annual report of Liangpin Shop, by the end of 2022, the controlling shareholder of Liangpin Shop was Ningbo Hanyi Venture Capital Partnership (Limited Partnership) (hereinafter referred to as "Ningbo Hanyi"). Ningbo Liangpin Investment Management Co., Ltd. (hereinafter referred to as "Ningbo Liangpin"), Ningbo Hanliang Qihao Investment Management Partnership (limited partnership), Ningbo Hanlin Zhihao Investment Management Partnership (limited partnership) (hereinafter referred to as "Ningbo Hanlin"), Ningbo Hanning Beihao Investment Management Partnership (limited partnership), Ningbo Hanning. Yang Hongchun, Yang Yinfen, Zhang Guoqiang and Pan Jihong are the actual controllers of Liangpin Store. Among them, Yang Hongchun is the chairman and general manager of Liangpin Store.

According to the Prompt Announcement on Dissolving the Relationship of Concerted Action between Controlling Shareholders and Some Concerted Actions signed by Liangpin Store on March 7, 2023, Liangpin Store received the notice of dissolving the relationship of concerted action from Ningbo Hanyi, the controlling shareholder, Ningbo Liangpin, Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang on March 6, 2023. After all partners reached a consensus, Ningbo Hanliang, Ningbo Hanlin and Ningbo Hanliang recently.

Since Yang Hongchun no longer serves as the executive partner of Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang, the relationship between Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang and Ningbo Hanyi and Ningbo Liangpin is dissolved, Ningbo Hanyi and Ningbo Liangpin are still acting in concert.

In short, Yang Hongchun, the real controller of Liangpin Store, was originally an executive partner of Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang, and therefore formed a concerted action relationship with Ningbo Hanyi, the controlling shareholder. By March 2023, Yang Hongchun no longer served as the executive partner of the above four institutions, so the relationship of concerted action was dissolved.

According to the Announcement of Shareholder’s Shareholding Reduction Results signed by Liangpin Store on December 7, 2023, from June 9, 2023 to December 5, 2023, Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang reduced their shareholdings by 6,015,000 shares through centralized bidding, accounting for 1.5% of the total share capital.

The reduction price is 19.28-25.44 yuan/share, and the total reduction amount is 140 million yuan.

After the implementation of this reduction plan, Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang jointly held 9,742,651 shares of Liangpin Store, accounting for 2.43% of the total share capital.

It should be noted that according to the data of the Market Supervision Administration, as of the inquiry date of January 10th, 2024, Yang Hongchun’s shareholding ratio for Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang all exceeded 40%, making him the largest shareholder.

It can be seen that the controlling shareholder has dissolved the relationship of concerted action with Ningbo Hanliang, Ningbo Hanlin, Ningbo Hanning and Ningbo Hanliang. Judging from the shareholding ratio of the partners of the above-mentioned enterprises, the actual controller Yang Hongchun may be the "main force" for this cash.

According to the data of Oriental Fortune Choice, from the date of the announcement of the first round of reduction plan of Gaochun Capital to the date of the expiration of the reduction period of shareholders such as Ningbo Hanliang, the stock price of Liangpin Store reached the highest point on March 2, 2021, with a closing price of 60 yuan/share and a total market value of 24.06 billion yuan. As of December 5, 2023, the stock closing price of Liangpin Store was 24.65 yuan/share, with a total market value of 9.885 billion yuan.

It is estimated that the total market value of good shops may have evaporated by 14.175 billion yuan during the period when the above shareholders reduced their holdings.

The decline of stock price is influenced by many factors, such as the performance change of listed companies, shareholder reduction and so on. After the lifting of the ban on the shares held by the above shareholders, the market value of good shops evaporated by tens of billions of yuan, and how did the frequent reduction of shareholders affect it?

Three, based on the "business layout" investment in Zhao Yiming food, half a year that is, selling benefits of about 60 million yuan.

In recent years, convenience stores and snack shops that mainly serve community users have achieved rapid growth with richer products, better consumption experience and higher cost performance, and have become an important force to promote the development and growth of the snack industry.

According to the record of investor relations activities of Liangpin Store in August, 2023, regarding the issue of "measures to deal with competition in the development of volume distribution channels",One of the measures that the good shops responded to was to actively expand the discount snack business by investing in "Snack Stubborn Home" and "Zhao Yiming Snacks".

According to the public information of Black Ant Capital’s WeChat public platform on March 7, 2023, in March 2023, Zhao Yiming Snacks, a snack collection store brand, completed a series of financing of 150 million yuan, which was led by Black Ant Capital and followed by good shops.

According to the public information of Zhao Yiming Food official website, in January 2019, the "Zhao Yiming Snacks" brand was established and the first direct store opened. In October 2019, the first franchise store opened. In October 2022, the total number of "Zhao Yiming Snacks" nationwide exceeded 500. In February 2023, the total number of stores in China exceeded 1,000. In August 2023, the total number of stores in China exceeded 2,000.

Only three years after the establishment of the brand, the number of "Zhao Yiming Snacks" stores has exceeded 2,000, and the development speed is obvious.

However, while the brand of "Zhao Yiming Snacks" is growing rapidly, Liangpin Store only invested in Zhao Yiming Food for half a year, and then sold the underlying equity.

According to the Announcement on Sale of Assets by Wholly-owned Subsidiaries signed by Liangpin Shop on October 17th, 2023, Ningbo Guangyuan Juyi Investment Co., Ltd., a wholly-owned subsidiary, intends to transfer its 3% equity of Yichun Zhao Yiming Food Technology Co., Ltd. (hereinafter referred to as "Zhao Yiming Food") to Shanghai Yihai Enterprise Management Consulting Partnership (Limited Partnership) and Xiamen Heiyi No.3 Overseas Connection Venture Capital Partnership (Limited Partnership) at a total price of about 105 million yuan.

According to this announcement, after the completion of this transaction, Liangpin Store will no longer hold the equity of Zhao Yiming Food, and at the same time, it is expected to generate an investment income of about 60 million yuan in the current period at the consolidated statement level due to the sale of the equity of Zhao Yiming Food.

That is to say, in the face of the rapid growth of snack distribution channels, Liangpin Store declared to investors that it would expand its business by investing in Zhao Yiming Food, but in only half a year, Liangpin Store "hastily" transferred its equity in Zhao Yiming Food, thus obtaining an investment income of about 60 million yuan. In this case, is the good shop investing in Zhao Yiming Zero Food out of business layout or financial investment?

Fourth, the performance in the first three quarters was negative year-on-year, but the gross profit margin of the self-proclaimed "first share of high-end snacks" was not as good as that of peers.

As mentioned above, at the "end" of the first round of the shareholding reduction of Gaochun Capital, the good shops "buy back the shares on dips" for the employee stock ownership plan.

The implementation of employee stock ownership plan can bind the interests of employees with the interests of the company, improve the enthusiasm of employees and create more profits for the company. Therefore, there are certain assessment conditions for the granting and unlocking of equity.

According to the Employee Stock Ownership Plan (Revised Draft) in 2023, the underlying stocks obtained by the employee stock ownership plan will be unlocked by stages 12 months after the last underlying stock of Liangpin Store is transferred to the name of the employee stock ownership plan. The specific arrangements are as follows:

The first batch of unlocking time: it is 12 months from the date when the last target stock of Liangpin Store is transferred to the name of this employee stock ownership plan, and the number of unlocked shares is 33% of the total number of target stocks held by this employee stock ownership plan.

The second batch of unlocking time: 24 months from the date when the last target stock of Liangpin Store was transferred to the name of this employee stock ownership plan, and the number of unlocked shares is 33% of the total number of target stocks held by this employee stock ownership plan.

The third batch of unlocking time: it is 36 months since the last target stock of Liangpin Store was transferred to the name of this employee stock ownership plan, and the number of unlocked shares is 34% of the total number of target stocks held by this employee stock ownership plan.

If the performance appraisal indicators at the company level corresponding to the first batch are not reached, the corresponding rights and interests shall not be unlocked, and the related rights and interests shall be recovered by the management committee at the original investment amount of the underlying stock corresponding to the share, and the management committee shall dispose of the recovered related rights and interests according to the plan approved by the board of directors. There is no company-level performance appraisal in the second and third unlocking periods of this employee stock ownership plan.

With regard to company-level performance assessment, based on the operating income or net profit value in 2022, the operating income growth rate or net profit growth rate of the assessment year, that is, the operating income or net profit value in 2023, is assessed.

That is, the growth rate of operating income or net profit in 2023 is higher than 20%, and the unlockable ratio at the company level is 100%; If it is higher than 16% but lower than 20%, the unlocking ratio is 80%; If it is less than 16%, the unlocking ratio is 0%.

It should be noted that the above-mentioned "net profit" refers to the net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses.

Looking back to the performance level of good shops.

According to the data of Oriental Fortune chioce, from 2019 to 2022 and from January to September in 2023, the operating income of good shops was 7.715 billion yuan, 7.894 billion yuan, 9.324 billion yuan, 9.44 billion yuan and 5.999 billion yuan respectively, with year-on-year growth rates of 20.97%, 2.32%, 18.11% and 5.999 billion yuan respectively.

In 2019-2022 and January-September 2023, the net profit of Liangpin Store after deducting non-recurring gains and losses from shareholders of listed companies was 274 million yuan, 275 million yuan, 206 million yuan, 209 million yuan and 122 million yuan respectively, with year-on-year growth rates of 31.78%, 0.57%, -25.15% and 1.2 million yuan respectively.

It is not difficult to see that in 2019, the performance of good shops was in a relatively "highlight moment", and the growth rate of revenue and net profit exceeded 20%. The following year, its performance growth slowed down. In 2021, there was no increase in income, but it increased slightly in 2022. By January to September 2023, its performance both fell into negative growth.

In this case, is it difficult for employees of good shops to unlock the corresponding performance appraisal indicators in the first batch of shares? The answer may be known after the announcement of the 2023 annual performance of Liangpin Store.

In addition, good shops boast of "the first share of high-end snacks", but the gross profit margin is not optimistic.

According to the semi-annual report of Liangpin Store in 2023, Liangpin Store said that it landed in the capital market as the first "cloud-listed" enterprise of Shanghai Stock Exchange in 2020 and became the first "high-end snack" in China. In addition, the good shop quoted the data of the "2022 Snack Market Research Report" of the China National Business Information Center, and disclosed that from 2015 to 2022, it led the domestic high-end snack sales for eight consecutive years.

However, the gross profit margin of good shops since listing may still be less than the average of peers.

According to the prospectus signed on January 21st, 2020, the comparable companies in the same industry of Liangpin Store include Shanghai Laiyifen Co., Ltd. (hereinafter referred to as Laiyifen), Haoxiangni Healthy Food Co., Ltd. (hereinafter referred to as Haoxiangni), Three Squirrels Co., Ltd. (hereinafter referred to as "Three Squirrels") and Yanjinpu Food Co., Ltd. (hereinafter referred to as "Yanjinpu Store").

According to the annual report of Liangpin Store in 2020-2022, the gross profit margin of Liangpin Store’s main business in 2020-2022 was 27.45%, 26.98% and 27.67% respectively.

According to the above-mentioned annual reports of comparable companies in the same industry and the data of Oriental Fortune Choice, from 2020 to 2022, the gross profit margin of your main business is 17.76%, 25.03% and 22.69% respectively. The gross profit margin of the main business in Iraq is 42.13%, 42.46% and 41.92% respectively; The gross profit margin of the main business of the three squirrels is 23.9%, 29.38% and 26.74% respectively; The gross profit margin of Yanjin Shop’s main business is 43.83%, 35.71% and 34.72% respectively.

It is estimated that the gross profit margin of the main business of the above-mentioned comparable companies in the same industry will be 31.91%, 33.15% and 31.52% respectively from 2020 to 2022, which is higher than the gross profit margin of the main business of Liangpin Store in the same period.

It can be seen that in 2020-2022, the gross profit margin of the main business of good shops was lower than the average of peers. Therefore, does the gross profit margin level of the above-mentioned main business of Liangpin Shop contradict with the "high-end" positioning?

Continue to pay attention to the employee stock ownership plan of the good shop.

Five, the draft employee stock ownership plan was revised in a hurry one day after it was announced, and the share payment fee was reduced by more than 20 million yuan.

According to the announcement signed by Liangpin Store on January 12, 2023, Liangpin Store held the first employee representative meeting, the 18th meeting of the second board of directors and the 14th meeting of the second board of supervisors in 2023 on January 11, 2023, and deliberated and passed the Proposal on the Company’s Employee Stock Ownership Plan (Draft) in 2023 and the Administrative Measures on the Company’s Employee Stock Ownership Plan in 2023.

On the signing date of the above announcement, Liangpin Store also announced the 2023 Employee Stock Ownership Plan (Draft), and the price of the shares repurchased by Liangpin Store in the employee stock ownership plan is 9.9 yuan/share. The total number of employees participating in this employee stock ownership plan shall not exceed 90.

Among them, there are 9 supervisors and senior managers, namely, Li Haohao, Jia Liming, Liu Ling, Jin ‘an, Xu Ran, Ke Bingrong, Xuanmingfeng, Ma Teng and Wan Zhang Nan, and their total share accounts for 37.84% of the total planned share. The total share of other middle and senior managers and core professionals accounts for 62.16% of the total planned share.

The source of the underlying stock involved in this employee stock ownership plan is the common stock of Liangpin Store.

As for the share payment fee, it is assumed that the employee stock ownership plan will transfer 3,016,600 shares of Liangpin Store held in the special securities account for Liangpin Store repurchase to the employee stock ownership plan by means of non-transaction transfer at the end of February 2023, with the closing price of Liangpin Store on January 11, 2023 (35.35 yuan/share) as the forecast, and the share payment fee will total 76,772,500 yuan.

Oddly, the next day, Liangpin Store revised the 2023 Employee Stock Ownership Plan (Draft), which was reviewed and approved by the Board of Directors and the Board of Supervisors.

According to the "2023 Employee Stock Ownership Plan (Revised Draft)" signed by Liangpin Store on January 13, 2023, after the revision of the draft, the price of the stock repurchased by the employee stock ownership plan is 16.7 yuan/share. The upper limit of the share to be held by the incentive object is increased, and the corresponding proportion of the total share of the plan remains unchanged.

Assume that the employee stock ownership plan will transfer 3,016,600 shares of Liangpin Store held in the special securities account for Liangpin Store repurchase to the employee stock ownership plan at the end of February 2023 by means of non-transaction transfer and other laws and regulations, and the stock payment fee will be 53,031,800 yuan based on the closing price of Liangpin Store shares on January 12, 2023.

In other words, after the price changes, the calculated share payment fee disclosed by the good shop may be reduced by RMB 23,740,700.

Disclaimer: The analysis of this study is based on the information we believe to be reliable or published, and we do not guarantee that the data, materials, opinions or statements in this paper will not change. In any case, the data, materials, opinions or opinions expressed in this research and analysis are only for information exchange, sharing and reference, and do not constitute investment advice for anyone. In any case, we are not responsible for any losses caused by anyone using any data, materials, opinions and contents in this research analysis, and the readers bear their own risks. The analysis of this study is mainly distributed in the form of electronic version, supplemented by printed form, and the copyright belongs to Jinzhengyan. Without our consent, this research and analysis shall not be quoted, abridged or modified against the original intention, and shall not be used for profit or for other purposes without permission.

Zhang Guozhong, Executive Deputy General Manager of Chery Automobile Co., Ltd.

Zhang Guozhong, Executive Deputy General Manager of Chery Automobile Co., Ltd. A new benchmark for ultra-luxury medium-sized electric hybrid SUV-Fengyun T9 opens for pre-sale.

A new benchmark for ultra-luxury medium-sized electric hybrid SUV-Fengyun T9 opens for pre-sale. The world’s leading 5G black light factory

The world’s leading 5G black light factory Li Xueyong, Deputy General Manager of Chery Automobile Co., Ltd.

Li Xueyong, Deputy General Manager of Chery Automobile Co., Ltd. Open several times, the actual measurement continues to lead the generation.

Open several times, the actual measurement continues to lead the generation. Kunpeng Super Hybrid C-DM

Kunpeng Super Hybrid C-DM Women’s volleyball world champions Zhao Ruirui, Wei Qiuyue and Yan Ni appeared at the press conference.

Women’s volleyball world champions Zhao Ruirui, Wei Qiuyue and Yan Ni appeared at the press conference.