Jing Zheng Fa [2021] No.20

District People’s governments, municipal government commissions, offices and bureaus, and municipal institutions:

The "Implementation Plan of Rural Revitalization Strategy in Beijing during the 14th Five-Year Plan" is hereby printed and distributed to you, please implement it carefully.

the people’s government of beijing city

July 31, 2021

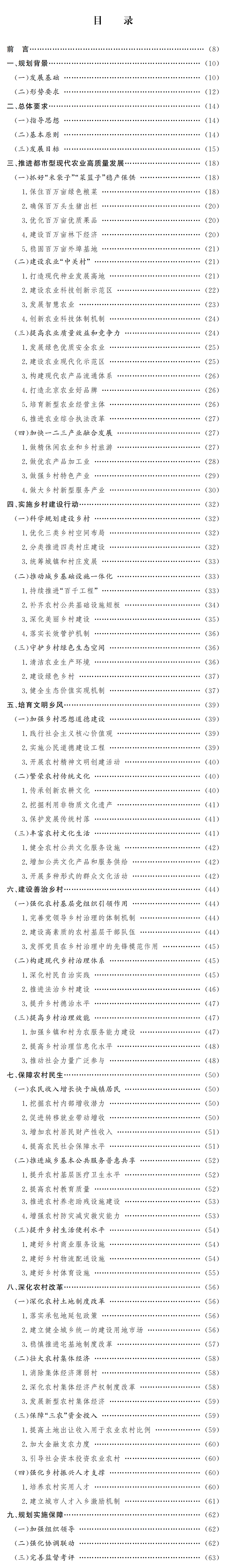

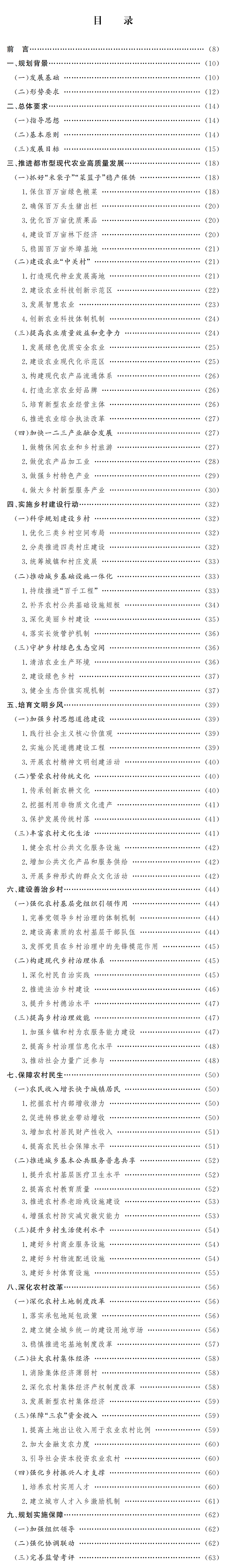

Implementation Plan of Rural Revitalization Strategy in Beijing during the Tenth Five-Year Plan Period

foreword

The "14th Five-Year Plan" period is the first five years for China to start a new journey of building a socialist modern country in an all-round way and March towards the second century goal after building a well-off society in an all-round way and realizing the first century goal. It is also a crucial period for Beijing to implement its strategic positioning as a capital city and build a world-class harmonious and livable capital. If the nation is to be revived, the countryside will be revitalized. General Secretary of the Supreme Leader emphasized that without the modernization of agriculture and rural areas, there would be no modernization of the whole country. The 15th Plenary Session of the 12th CPC Central Committee made it clear that Beijing should be at the forefront of the country and take the lead in basically realizing socialist modernization. Guided by the Supreme Leader’s Socialism with Chinese characteristics Thought in the New Era, it is of great significance for Beijing to make a good start in basically realizing socialist modernization by scientifically planning the ideas, objectives and key tasks of implementing the rural revitalization strategy during the 14th Five-Year Plan period, giving priority to developing agriculture and rural areas and comprehensively promoting rural revitalization.

This plan implements the spirit of Opinions of the Central Committee of the Communist Party of China and the State Council on Comprehensively Promoting Rural Revitalization and Accelerating Agricultural and Rural Modernization, the 14th Five-year Plan for National Economic and Social Development of People’s Republic of China (PRC) and the Outline of Long-term Goals in 2035, and implements the Promotion Law of Rural Revitalization in People’s Republic of China (PRC). According to the Beijing Urban Master Plan (2016 -2035), the Outline of the 14th Five-year Plan for Beijing’s National Economic and Social Development and the Outline of the Long-term Goals in 2035, and the Notice of the Beijing Municipal People’s Government of the CPC Beijing Municipal Committee on Printing and Distributing the Strategic Plan for Rural Revitalization in Beijing (2018-2022), the strategic intentions of the municipal party committee and the municipal government on the work concerning agriculture, rural areas and farmers are systematically expounded.

I. Planning background

During the "Thirteenth Five-Year Plan" period, the city thoroughly implemented the important exposition of the Supreme Leader General Secretary on the work concerning agriculture, rural areas and farmers and the spirit of his important speech to Beijing. In accordance with the general requirements of industrial prosperity, ecological livability, rural civilization, effective governance and affluent life, the city solidly promoted the implementation of the rural revitalization strategy and introduced a series of policies and measures to strengthen agriculture, benefit farmers and enrich farmers. The overall rural revitalization started well, laying a solid foundation for taking the lead in basically realizing agricultural and rural modernization.

(A) the basis for development

The task of improving rural human settlements has been completed in an all-round way, and significant progress has been made in the construction of beautiful countryside. The "Hundred Villages Demonstration and Thousand Villages Renovation" project has been implemented in depth, and the village planning has achieved "all compilation", and the domestic garbage treatment in administrative villages has basically achieved full coverage. The coverage rate of rural domestic sewage treatment facilities has reached more than 50%, and the coverage rate of harmless sanitary toilets has reached 99.3%. The integration of urban and rural water supply has been accelerated, and the construction of "four good rural roads" has achieved fruitful results. The work of "changing coal into clean energy" in rural areas has achieved remarkable results, and rural areas in plain areas have basically achieved "no coal".

Low-income farmers’ task of getting rid of poverty has been fully realized, and the ability of rural people’s livelihood security has been significantly enhanced. The "six batches" of precise assistance have achieved remarkable results, and the income of low-income farmers has completely crossed the line, and low-income villages have been completely eliminated. The level of social security continued to improve, and the basic pension, welfare pension and minimum living standard for urban and rural residents increased by 74.5%, 90.1% and 74.6% respectively compared with 2015. The quality of running schools in rural areas has been continuously improved, the primary medical and health service system has been continuously improved, facilities and services for the disabled and the elderly have been gradually improved, and the gap between urban and rural basic public services has been further narrowed.

The task of "turning around the festival" in agriculture has been fully completed, and the level of green development has been steadily improved. The utilization rate of chemical fertilizers increased from 29.8% in 2015 to 40.7%, the utilization rate of chemical pesticides increased from 39.8% to 44.2%, the utilization coefficient of irrigation water in farmland reached 0.735, and the coverage rate of agricultural products with "three products and one standard" reached 81.7%. Vegetables have achieved full coverage of improved varieties, and the contribution rate of agricultural scientific and technological progress has reached 75%. A total of 38 beautiful leisure villages in China, 32 national key villages for rural tourism and 274 star-rated folk-custom tourist villages have been established, and there are 699 rural boutique homestay brands.

Rural reform was comprehensively promoted, and the system and mechanism of urban-rural integration development were initially established. We have formulated and promulgated "village area management" and guiding opinions on homestead and housing construction, and the management and control of rural collective land has been comprehensively strengthened. The issuance rate of the certificate of ownership of the contracted land reached 98.5%, the idle homestead was revitalized and utilized with initial results, and the pilot reform of collectively-operated construction land was successfully completed. The reform of the collective property rights system continued to deepen. The twinning cooperation mechanism between ecological conservation areas and plain areas has been formally established, and the support of public finance for "agriculture, rural areas and farmers" has been increasing.

The party’s leadership over rural work has been comprehensively strengthened, and the rural governance system has been continuously improved. The Municipal Party Committee set up a leading group for rural work, issued measures for the implementation of rural work regulations, and the "five-level secretary pays attention to rural revitalization" requires in-depth implementation. The new village "two committees" general election was completed, and the proportion of "one shoulder to shoulder" reached 91%. Party construction has led the reform of "whistle for reporting" and the mechanism of "handling complaints immediately" to deepen and expand in rural areas, and the rectification of party organizations in "weak and scattered villages" has made progress in stages. The new era civilization practice center (institute, station) realizes the full coverage of districts, towns and villages. The construction of rural spiritual civilization and farming culture has been continuously strengthened, and new achievements have been made in promoting the revitalization of rural culture. 72 villages and towns in the city were awarded the title of national civilized villages and towns, and 11 villages and towns were awarded the title of national rural governance demonstration villages and towns.

(2) The situation requires

The "14th Five-Year Plan" period is the beginning of the new journey of building a socialist modern country in an all-round way, and it is also the key period for Beijing to build a world-class harmonious and livable capital. Comprehensive analysis shows that the development of agriculture, rural areas and farmers in Beijing faces five opportunities: first, accelerating the construction of a new development pattern is conducive to deepening the understanding of the top priority of the work of agriculture, rural areas and farmers, taking the urban-rural economic cycle as the proper meaning of the domestic circular problem, releasing the investment space and demand of agriculture and rural areas, and giving better play to the role of agriculture and rural areas as "ballast stones" and "strategic backyard" in emergency response and new development; Second, to serve the functional construction of the "four centers" in the capital, enhance the service support ability for major events, and meet the demand for high-quality agricultural products of the citizens of the capital, which is conducive to deepening the structural reform of the agricultural supply side and accelerating the high-quality development of agriculture; Third, fully implement the new general regulations and deepen the pairing cooperation between ecological conservation areas and Pingyuan areas, which is conducive to strengthening agriculture with industry and rural areas with cities, accelerating the formation of a new type of relationship between workers, peasants and urban areas, and promoting the integration and development of urban and rural areas to be at the forefront of the country; Fourth, the coordinated development strategy of Beijing-Tianjin-Hebei is advancing in depth, which is conducive to optimizing the allocation of agricultural resources in a wider scope and building a "one-hour living security circle" around Beijing with a higher level of agricultural regional cooperation; Fifth, a new round of scientific and technological revolution and industrial transformation, represented by digital technology and biotechnology, has developed in depth, which is conducive to building a "sophisticated" Beijing plate of agriculture, building smart agriculture and empowering agriculture to achieve leapfrog development.

At the same time, we should also be soberly aware that Beijing should take the lead in basically realizing socialist modernization and be at the forefront of the country. The most arduous and arduous task is still in the countryside, and the most prominent shortcoming is still the modernization of agriculture and rural areas. The development of agriculture and rural areas in the city is still facing a series of problems and challenges intertwined with the old and the new: the self-sufficiency rate of major "vegetable basket" products has been declining for many years, the ability of stable production and supply of important agricultural products needs to be consolidated and improved, the output of vegetables has declined for 17 consecutive years, and the self-sufficiency rate is less than 10%, and meat. The advantages of agricultural science and technology are not fully exerted, the quality of development is not high, the technical reserves of efficient facilities are insufficient, and the application scenarios of digital technology in the agricultural field are not many, and the transformation effect is not obvious. Rural infrastructure and public services are still weak, and there is still a big gap between rural planning and construction and the goal of being beautiful and livable. The domestic sewage treatment rate is 34 percentage points lower than the average level of the city, and the proportion of health technicians in village clinics is 65 percentage points lower than that in community health service centers. It is increasingly difficult for farmers to increase their income. The income ratio of urban and rural residents is 2.51∶1, ranking 22nd in the country. The absolute income gap has expanded from 32,290 yuan in 2015 to 45,476 yuan in 2020.

In the new stage of development, the work on agriculture, countryside and farmers is still extremely important, and we must not relax for a moment, so we must pay close attention to it. The work concerning agriculture, countryside and farmers in the whole city should be people-centered, with two overall situations in mind, enhance the awareness of opportunities and risks, establish the bottom line thinking, accurately grasp the new features and requirements of capital development, deeply understand the new opportunities and challenges faced by agricultural and rural development, handle the relationship between "capital" and "city", "city" and "township" as a whole, and make a good connection between agricultural and rural modernization and urban modernization on the basis of mutual demand, equality and reciprocity between urban and rural areas. Write a good article on the complementarity between urban and rural areas, cultivate opportunities and create new opportunities in better implementing the strategic positioning of the capital city and serving the function construction of the "four centers", constantly create a new situation in the development of the "three rural" undertakings in the capital with the first good standard, and embark on a road of rural revitalization with the characteristics of the capital.

Second, the overall requirements

(A) the guiding ideology

Guided by Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, fully implement the spirit of the 19th National Congress of the Communist Party of China and the 2nd, 3rd, 4th and 5th Plenary Sessions of the 19th National Congress, implement the spirit of the 15th Plenary Session of the 12th Municipal Committee, promote the overall layout of "five in one", coordinate and promote the "four comprehensive" strategic layout, unswervingly implement the new development concept, adhere to the general tone of striving for progress while maintaining stability, and persist in strengthening the Party’s overall leadership over the work concerning agriculture, rural areas and farmers. Firmly grasp the strategic positioning of the capital city, accurately grasp the market conditions and agricultural conditions of Beijing’s "big cities, small agriculture" and "small urban areas in the suburbs of Beijing", take the development of the capital as the guide, take the big cities as the development strategy, promote the high-quality development of agriculture and rural areas as the theme, deepen the structural reform of the agricultural supply side as the main line, take reform and innovation as the fundamental driving force, and meet the people’s growing needs for a better life as the fundamental purpose. Taking strengthening the leadership of the Party as the fundamental guarantee, making overall plans for development and security, giving priority to the development of agriculture and rural areas, promoting rural revitalization in an all-round way, strengthening the use of industry to supplement agriculture and the use of cities to lead rural areas, accelerating the formation of a new type of relationship between workers and peasants, complementing each other, coordinating development and common prosperity between urban and rural areas, and promoting the modernization of agriculture and rural areas, rural governance system and governance capacity with high quality.

(2) Basic principles

-Adhere to the Party’s leadership and gather strength for development. Unswervingly uphold and strengthen the party’s leadership over rural work, improve the party’s leadership system and mechanism for rural work, and provide a strong political guarantee for rural revitalization.

-Adhere to farmers as the main body and develop in an all-round way. Fully respect the wishes of farmers, widely mobilize their enthusiasm, initiative and creativity, protect their rights and interests according to law, and let farmers have more sense of gain, happiness and security in rural revitalization.

-Adhere to the overall planning and integrated development of urban and rural areas. Adhere to the integrated development of urban and rural areas, focus on improving the institutional mechanisms and policy systems for the integrated development of urban and rural areas, promote more high-quality resource elements to flow to the countryside, and enhance the vitality of agricultural and rural development.

-persist in strengthening agriculture through science and technology and innovating development. Give full play to the scientific and technological advantages of the capital, implement the innovation-driven development strategy in depth, improve the independent innovation ability of agricultural science and technology and the level of transformation of achievements, and expand new space and add new kinetic energy for rural revitalization.

-Adhere to green ecology and high-quality development. Practice the Lucid waters and lush mountains are invaluable assets concept, adhere to the harmonious coexistence between man and nature, effectively change the development mode, and embark on a green and high-quality rural revitalization road with capital characteristics.

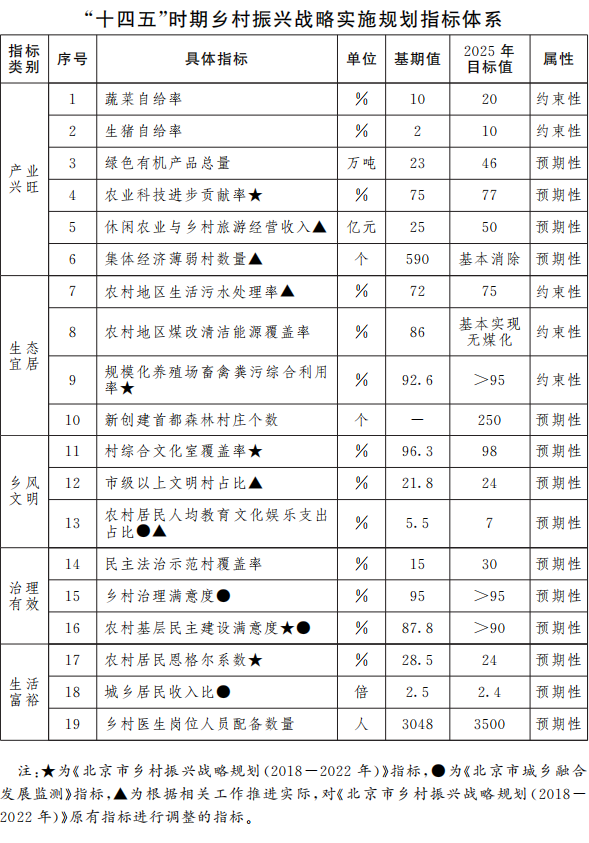

(3) Development goals

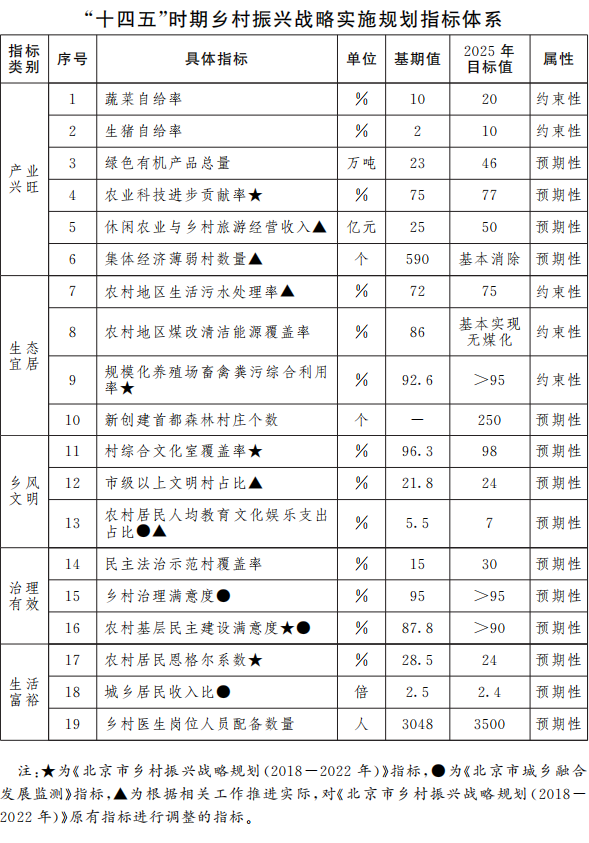

By 2025, rural revitalization has achieved important phased results, the institutional framework and policy system are basically sound, and breakthroughs have been made in the integration of urban and rural development. New achievements have been made in agricultural development, the agricultural foundation has become more stable, the self-sufficiency rate of important agricultural products has been significantly improved, the ability of science and technology to support the high-quality development of agriculture has been significantly improved, and the modern rural industrial system has basically taken shape, becoming a "cornucopia" for farmers to increase their income and become rich; New progress has been made in ecological livability, and the task of building beautiful countryside has been fully completed. The countryside has become a happy home and "meeting room" for ordinary people; New progress has been made in the revitalization of rural culture, and the degree of rural social civilization has been further improved, which has fully boosted farmers’ "spirit"; Rural people’s livelihood has reached a new level, the level of equalization of basic public services in urban and rural areas has improved significantly, and the income ratio of urban and rural residents has further narrowed, making farmers’ "money bags" bulging; The efficiency of rural governance has been improved, the party’s leadership over rural work has become stronger, the modern rural governance system combining autonomy, rule of law and rule of virtue has been improved, and the rural society has maintained harmony and stability.

By 2035, decisive progress will be made in rural revitalization, and the institutional mechanism for urban-rural integration and development will be comprehensively improved; Take the lead in basically realizing agricultural modernization and building a modern rural economic system; Take the lead in basically realizing rural modernization and build beautiful and livable villages in an all-round way; Take the lead in basically realizing the modernization of rural governance system and governance capacity, and the rural society is harmonious, prosperous and stable; The basic public services in urban and rural areas have been equalized, the gap between urban and rural regional development and the gap between residents’ living standards has been significantly reduced, the life of rural residents has been better, and all farmers have made substantial progress in common prosperity.

Third, promote the high-quality development of urban modern agriculture

Firmly hold the bottom line of agricultural development space, strengthen the market demand orientation, deepen the structural reform of agricultural supply side, strengthen the guidance of scientific and technological innovation, continuously enhance the ability of stable production and supply of important agricultural products, improve the quality and level of supply, dig deep into various functions and values of agriculture, and comprehensively improve agricultural efficiency and competitiveness.

(A) do a good job of "rice bags" and "vegetable baskets" to ensure stable production and supply.

Further consolidate the basic position of agriculture, firmly hold the "five million" agricultural basic plate, do a good job in the production of "rice bags" and "vegetable baskets", strive to improve the self-sufficiency rate and control of agricultural products such as vegetables and meat, and ensure the supply security of important agricultural products.

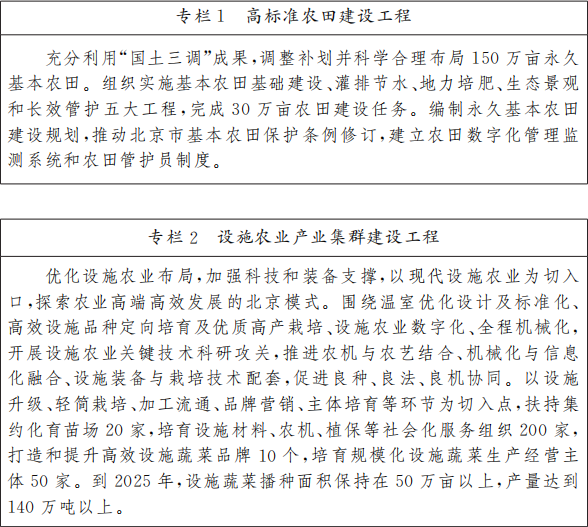

1. Keep one million mu of green grain and vegetables.

Adhere to the strictest farmland protection system, strictly observe the bottom line of 1.5 million mu of permanent basic farmland and 1.66 million mu of cultivated land, implement 2 million mu of cultivated land protection space, delimit the red line of permanent basic farmland and the bottom line of vegetable field area, and implement the strategy of "storing grain in the ground and storing grain in technology". We will fully implement the "long-term system", implement a list system for taking over and leaving office, and include the protection of cultivated land in the audit scope of natural resources assets of leading cadres. Take the measures of "long teeth", resolutely curb the "non-agricultural" of cultivated land, clean up and rectify the non-agricultural land within the scope of basic farmland, comprehensively carry out the verification and utilization of idle facilities and abandoned cultivated land, carry out special rectification actions for building houses in rural areas, basically complete the rectification of the stock problem before the end of 2022, and improve the long-term mechanism of daily supervision. Increase the construction of permanent basic farmland, effectively improve the fertility and quality of cultivated land, and promote the construction, transformation and upgrading of high-standard farmland. By 2025, the irrigation water utilization coefficient of farmland will be increased to above 0.75. We will implement the responsibility of the party and government for food security, decompose the indicators of grain sown area into districts, and create a number of high-yield demonstration parties to ensure that grain production will only increase at the level of 2020. We will build three vegetable industrial belts in the southeast, northeast and northwest, steadily increase the area of vegetable fields, strengthen the transformation and utilization of old facilities, improve the multiple cropping index, and build 100,000 mu towns, 100,000 mu villages and 1,000 mu gardens. Around the northwest, northeast and south of the Sixth Ring Road, a pilot project of 5,000 mu of agricultural land with efficient facilities will be carried out. By 2025, the output of vegetables will reach 2.2 million tons.The self-sufficiency rate has increased to over 20%.

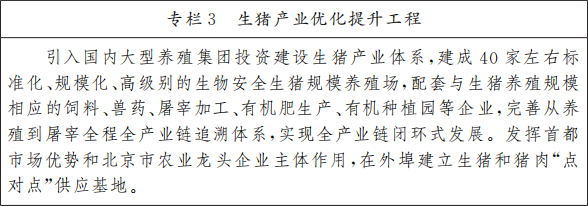

2. Ensure that millions of pigs are slaughtered.

Stabilize pig production, increase support, promote industrial transformation and upgrading, and build a number of modern breeding enterprises. By 2025, the number of pigs in the city will be no less than 500,000, and more than 890,000 commercial pigs will be provided annually, achieving a self-sufficiency rate of pork of 10%. Build an efficient and green pig industry, speed up the resource utilization of aquaculture waste, and realize the combination of planting and breeding. Accelerate the construction of a modern aquaculture system and continue to stabilize the development of poultry, dairy cows, fisheries and other aquaculture industries. Coordinate the prevention and control of animal diseases, establish a high-level biosafety prevention and control system, form a three-layer biosafety barrier for cities, production areas and farms, and compact the main responsibility of disease prevention and control of breeding enterprises.

3. Optimize one million mu of high-quality fruit.

Promote the orchard "quality improvement and efficiency improvement" project, the modern fruit tree industry science and technology service support system and the construction of the "Jingzihao" fruit tree protection and utilization system, and promote key technologies such as variety optimization, soil improvement, water-saving irrigation, orchard mechanization and bee pollination. Focus on small varieties, cultivate big brands, build regional public brands of "Beijing Fruit", and build 50 demonstration bases for cherry, peach, grape, pear and apple varieties breeding and high-standard production. By 2025, the area of orchards for demonstration and promotion of new construction, renovation, quality improvement and efficiency improvement will reach 1 million mu.

4. Build a million mu of under-forest economy

Make scientific and efficient use of forest land resources, formulate implementation opinions to promote the high-quality development of under-forest economy, make scientific and efficient use of forest resources and green space, encourage the development of industries closely related to forest tourism, under-forest leisure, forest health, nature education, outdoor expansion, promote the development of green industries such as under-forest beekeeping, forest product collection and processing, and actively explore the industrial integration development model of "under-forest planting+natural experience". By 2025, a number of demonstration bases for under-forest economy will be built, and 1 million mu of forest land resources will be used efficiently, with a total output value of more than 2 billion.

5. Stabilize one million mu of foreign base.

Focusing on the implementation of the Beijing-Tianjin-Hebei agricultural cooperation project, we will build a number of automatic control bases for meat, eggs, vegetables and milk around Beijing and Tianjin, which will be connected with the agricultural product sales network in the capital to improve the market control rate of "vegetable basket" products. Strengthen the deep integration and development of grain production and marketing, and accelerate the construction of a four-hour grain logistics circle around Beijing. Encourage leading enterprises to build stable and controllable pig breeding and slaughtering and processing bases around Beijing and establish a "point-to-point" supply model. Establish a demonstration and transformation base for new crop varieties around Beijing and a breeding base for improved livestock and poultry. Support the development of Shuanghe Farm, the first agricultural farm in Heilongjiang, and Qinghe Farm in Tianjin. Deepen regional cooperation in agriculture and promote international exchanges and pragmatic cooperation in agriculture.

(B) the construction of agricultural "Zhongguancun"

Serve the country’s agricultural science and technology for self-reliance, incorporate agricultural science and technology innovation into the construction strategy of Beijing International Science and Technology Innovation Center, focus on promoting independent innovation and original innovation, and strengthen the support of modern agricultural science and technology and material equipment.

1. Create a highland for the development of modern seed industry

Give full play to Beijing’s advantages in science and technology and talents, accelerate the construction of a national seed science and technology innovation center, and build a "seed capital". Work out and implement the 10-year plan for the joint research of Beijing provenance "stuck neck", carry out the joint research of important variety breeding and provenance "stuck neck" technology, make positive progress in the independent control of important agricultural products provenance, and be a good seed industry to turn around and take the lead. Focus on innovative corn, wheat, vegetables, breeding pigs, laying hens, cows, Beijing ducks, peaches, native tree species and other dominant species, and select and promote a number of urban fine seeds and forest tree varieties. Actively undertake major scientific and technological projects of national agricultural biological breeding, promote the industrial application of biological breeding in an orderly manner, and do a good job in the construction of major projects such as the National Maize Seed Industry Technology Innovation Center. Implement the third national survey and collection of crop, livestock and poultry and aquatic germplasm resources, and establish a municipal agricultural germplasm resources protection system. Promote the deep integration of science and technology enterprises, cultivate a group of modern seed enterprises with influence in the country, and establish and improve the commercial breeding system. Rolling implementation of the three-year action plan for the development of modern seed industry.

2. Construction of agricultural science and technology innovation demonstration zone

Efforts will be made to build an agricultural "Zhongguancun", accelerate the construction of Pinggu agricultural science and technology innovation demonstration zone with the agricultural science and technology innovation center as the engine, and form a "one core and multiple radiation" collaborative innovation development pattern in the city. In-depth development of rural revitalization of science and technology support action. Focus on modern seed industry, efficient agricultural facilities, intelligent equipment, digital agriculture and other key areas, and develop a number of core technologies with independent intellectual property rights. Actively undertake major tasks of national agricultural scientific research, and build provincial and ministerial key laboratories, comprehensive experimental stations of agricultural science and technology, and national modern agricultural technology demonstration and exhibition bases. Identify 100 municipal-level modern agricultural science and technology demonstration bases, and demonstrate to promote the improvement of agricultural science and technology level in the city.

3. Develop smart agriculture

Vigorously promote the construction of application scenarios, accelerate the application of next-generation information technologies such as artificial intelligence, 5G, Internet of Things, Beidou, big data and blockchain in the agricultural field, and promote the digital transformation of agricultural production, operation and management services. Build a big data platform for agriculture and rural areas in Beijing, and build a "one map" of agricultural and rural data resources in the city. Develop digital pastoral, intelligent breeding and intelligent agricultural gardens. Carry out research and demonstration application of intelligent agricultural machinery based on clean energy and modern information technology. We will implement four major projects, namely, upgrading high-efficiency facilities, livestock and poultry products, primary processing and agricultural waste treatment equipment, increase the informationization and intelligent upgrading of agricultural machinery and equipment, and comprehensively improve the intelligent level of facilities and equipment for facility agriculture and pig breeding. By 2025, the comprehensive mechanization rate of main crops and the comprehensive utilization rate of straw will reach over 98%, the mechanization rate of animal husbandry will reach 75%, and the mechanization rate of facility agriculture will reach 55%.

4. Innovating agricultural science and technology system and mechanism.

Gather a group of leading agricultural science and technology talents and innovation teams, implement the mechanism of "revealing the list and taking the lead" to stimulate the innovation vitality of talents. Explore the mechanism of sharing the rights and interests of achievements, transfer and transformation, and classification and evaluation of scientific research personnel, clarify matters such as part-time remuneration of scientific and technological personnel, and share the shares at the price of achievements, and increase incentives for the distribution of rights and interests of scientific research achievements. Improve the service response ability of science and technology commissioners, and establish a "one-on-one" contact and docking service mechanism between scientific and technological personnel and administrative villages. Deepen the reform of the title system of agricultural scientific and technological personnel and support agricultural technicians to write papers on the land in the suburbs of Beijing. Support agricultural research institutes and related stations to cooperate with various demonstration areas, industrial parks, excellent bases, professional villages and towns, and carry out technology demonstration and promotion. By 2025, the contribution rate of agricultural science and technology progress in the city will increase to 77%.

(3) Improve the quality, efficiency and competitiveness of agriculture.

Further promote the adjustment of agricultural structure, promote variety cultivation, quality improvement, brand building and standardized production, and comprehensively improve the level of agricultural scale, science and technology, marketization, standardization and organization.

1. Develop green, high-quality and safe agriculture.

Consolidate the achievements of the Ministry and city to jointly build a green, high-quality and safe demonstration zone for agricultural products. Improve the list of main producers of edible agricultural products and try out the certificate system of edible agricultural products. Improve the standardization system of green agriculture, promote the development of green organic agriculture, and strengthen the registration and protection of agricultural products with geographical indications. We will further promote standardized production and base construction, and increase the integration and comprehensive application of green prevention and control of agricultural product quality and safety and healthy breeding technology. Improve the quality and safety inspection and traceability system of agricultural products, strengthen the whole process of intelligent supervision, and carry out the pilot project of traceability of production entities. Strengthen the source risk management and control, improve the "four in one" risk management and control mechanism, and explore and promote the grid supervision of the quality and safety of grassroots agricultural products. Promote a number of green organic agricultural production technologies and promote the construction of green organic agricultural industrial zones in Yanqing, Miyun and Huairou. During the "Fourteenth Five-Year Plan" period, the qualified rate of agricultural products quality and safety monitoring and sampling was stable at over 98%.

2. Construction of agricultural modernization demonstration zone

The establishment of agricultural modernization demonstration zones will be carried out on a district basis. Focusing on improving the modernization level of agricultural industrial system, production system and management system, an index system will be established, and resources and policies will be integrated. By 2025, 2-3 agricultural modernization demonstration zones will be established. High-level construction of modern agricultural industrial parks, industrial clusters with distinctive advantages, and modern agricultural towns, the whole industrial chain will enhance agricultural competitiveness and lead the development and growth of rural industries. Create about 15 national and municipal modern agricultural industrial parks to drive the construction of various agricultural industrial parks and standardization bases.

3. Construct a modern agricultural product circulation system

Strengthen the construction of agricultural products storage and preservation and cold chain logistics facilities, and build 40 cold chain logistics facilities for agricultural products storage and preservation in combination with the city’s special logistics planning, so as to enhance the ability of "internet plus" agricultural products to leave the village and enter the city. Explore the new mode of "internet plus Tiantou Market+E-commerce Enterprise+Urban Terminal Distribution". Fully guarantee the supply of agricultural products for major events such as the 2022 Beijing Winter Olympics and Paralympic Games. By 2025, the cold chain circulation rate of fresh agricultural products in the city will increase to 50%.

4. Create a good agricultural brand in Beijing

Create regional public brands, enterprise brands and product brands of agricultural products, cultivate famous brands, encourage the restoration of "old tastes" according to local conditions, cultivate a number of local agricultural products with well-known brands and good market sales, and do a good job in the protection and development of geographical indication products. Strengthen quality identification and traceability management, standardize the authorized use of identification, strengthen the listing of products with labels, and establish and improve the traceability system of landmark products. Build a promotion platform, strengthen the brand promotion of "Jingzihao" agricultural products, connect with "Quality Grain Project", tell a good brand story and spread brand value.

5. Cultivate new agricultural management entities.

We will implement actions to improve the norms of farmers’ cooperatives and carry out pilot projects to improve the quality of farmers’ cooperatives throughout the region. Implement the family farm cultivation plan, establish and improve the family farm directory management system, improve the policy promotion mechanism, create a family farm demonstration area, and build a number of family farms with moderate scale, intensive production and obvious benefits. Support leading enterprises in agricultural industrialization to establish a comprehensive service center for the whole agricultural industry chain in Beijing. Improve the specialized and socialized service system of agricultural production, vigorously cultivate new service subjects, improve the service system of means of production based on the supply and marketing system, promote the integrated development of public welfare agricultural technology extension institutions and business service organizations, and realize the organic connection between small farmers and modern agriculture.

6. Promote the reform of comprehensive agricultural law enforcement.

Strengthen the construction of agricultural law enforcement team, build a comprehensive agricultural administrative law enforcement system with clear responsibilities, smooth command, efficient operation and strong guarantee, clarify the law enforcement authority at different levels, and clarify the division of responsibilities and law enforcement priorities. Strengthen the standardization of agricultural law enforcement, promote strict and standardized fair and civilized law enforcement, improve law enforcement procedures, and strengthen law enforcement supervision. Actively innovate law enforcement system and mechanism, improve law enforcement methods, guide, educate and help farmers to safeguard their legitimate rights and interests according to law.

(D) accelerate the integration and development of the primary, secondary and tertiary industries.

Adhere to the policy of serving the capital and wealthy farmers, deeply explore the multiple functions and values of agriculture and rural areas, build the whole industrial chain of agriculture, expand the efficiency of rural industries, and create more opportunities for employment and income increase.

1. Do fine leisure agriculture and rural tourism.

Promote the high-quality development of leisure agriculture in the city, and strive to design attractive, fine service to retain people, exquisite feelings to impress people, and create warm and close-up leisure agriculture boutique projects. Implement the "100 million" tour, build more than 10 boutique routes, create more than 100 beautiful leisure villages, upgrade more than 1,000 leisure agricultural parks, and transform nearly 10,000 folk reception households. We will launch a number of rural boutique homestays, build a number of villages and towns with special characteristics, and realize the overall improvement of the scale and quality of villages and towns in the city. Implement the requirements of labor education in primary and secondary schools in the new era, and build a number of practical education bases and rural complexes for young people’s farming culture. Encourage the development of rural fitness and leisure industry. By 2025, the annual reception of leisure agriculture and rural tourism will reach 40 million, and the operating income will reach 5 billion yuan.

2. Do a good job in agricultural product processing industry

Support the agricultural product processing industry to extend the industrial chain, enhance the value chain and improve the interest chain. Support leading enterprises in agricultural industrialization to drive farmers to develop primary processing and intensive processing of agricultural products, and improve the level of refrigeration, preservation and packaging. Improve the resource integration ability and product service scope of agricultural products processing enterprises, and strengthen enterprise quality control. Encourage the formation of industrial alliances with upstream and downstream market entities, so that farmers can share the value-added benefits. By 2025, the total output value of agricultural products processing enterprises above designated size will reach 150 billion yuan, and the output value of processing industry will be five times that of agriculture.

3. Strengthen rural characteristic industries

Vigorously develop small variety characteristic industries such as functional vegetables, organic fruits, green miscellaneous grains, bee industry and Chinese herbal medicines, strengthen a number of characteristic agricultural products such as Beijing Fatty Chicken, Beijing Duck, Pinggu Peach, Yanshan Chestnut, Shangfang Mountain Toona sinensis and Miyun Honey, and develop 100 national "one village, one product" demonstration villages. Support the development of local specialty industries such as specialty foods and specialty handicrafts, promote the development of handicraft creative products, and support rural handicraft products to participate in the selection of "Beijing gifts".

4. Develop new rural service industries.

We will develop and strengthen agricultural socialized service organizations, promote the extension of socialized services from mid-production to prenatal and postpartum links, and improve supporting services such as financial insurance, brand cultivation, e-commerce sales, and cold chain storage. Consolidate the development of public welfare services, strengthen agricultural specialized services, implement the small-scale farmers’ production trusteeship promotion project, and develop forms such as single-link trusteeship, multi-link trusteeship, key link trusteeship and whole-process trusteeship according to local conditions to expand the coverage of production trusteeship for small farmers. Develop rural e-commerce, build rural e-commerce terminal outlets, cultivate a number of leading enterprises in rural circulation e-commerce, accelerate the construction of a modern circulation system of agricultural products led by e-commerce platform, and promote agricultural products to go out of the village and enter the city.

Fourth, the implementation of rural construction action

Standing at the height of building a world-class harmonious and livable capital, we will make overall plans for urban and rural construction as an organic whole, promote the organic connection between rural infrastructure and rural modernization, optimize the ecological space for production and living, build a landscape village with Beijing charm, and realize the basic facilities for urban and rural residents’ living.

(A) scientific planning and construction of rural areas

Adhere to the guidance and orderly implementation of planning, adapt to the law of rural development and evolution, promote the construction of "three districts and four categories" villages by classification, form a wonderful rural space in Shu Lang, and reserve a nostalgic memory for the future.

1. Optimize the spatial layout of three types of rural areas.

Implement the division of three types of rural space: urban construction area, ecological protection red line area and rural landscape area, and scientifically arrange the ecological space of rural production and life. Guided by promoting urbanization transformation, improving the efficiency of production space and improving the quality of living space, urban construction areas promote the relative agglomeration and optimization of rural population space, support suburban areas to accelerate the urbanization process, and actively explore new paths for urban-rural integration and development. The red line area of ecological protection is guided by strengthening ecological protection and restoration, improving ecological function and improving ecological pattern, and maintaining and improving regional ecological function and its service value. The rural landscape area is oriented to promote the overall revitalization of the countryside, promote the development of villages by classification, and protect the rural characteristics.

2. Promote the construction of four types of villages by classification.

Implement village layout planning, adjust measures to local conditions, and promote the construction of four types of villages: urban agglomeration, overall relocation, characteristic upgrading and improvement, so as to achieve refined and differentiated development. Study and formulate the overall overall implementation plan for two types of villages: urban agglomeration and overall relocation, and define the implementation goals and plans by 2025. Give play to the leading role of characteristic upgrading villages, strengthen the protection of historical culture and traditional style and guide the overall style of villages, and encourage villages around the three cultural belts to be included in characteristic upgrading villages. Continue to promote the relocation of villages in areas prone to geological disasters and areas with poor living conditions in mountainous areas according to local conditions, and complete the fourth round of relocation tasks in mountainous areas.

3. Coordinate the development of towns and villages.

Implement the requirements of Beijing’s overall urban planning and zoning planning, compile the township land spatial planning, strengthen the development guidance for small towns and villages, and realize the full coverage of township land spatial planning by 2022. Promote the development and construction of new towns, small towns with characteristics and small towns by classification, speed up the improvement of public facilities, actively and orderly undertake the transfer of functions, industries and population in the central city, cultivate new kinetic energy for rural development, and strive to create new growth points for the development of Beijing suburbs. Promote the formation of a public service system with complementary functions of regional towns and villages, enhance the public service functions of towns and villages, and build towns and villages into regional centers serving farmers and important nodes for urban-rural integration and development.

(B) to promote the integration of urban and rural infrastructure

Adhere to the focus of public infrastructure construction in rural areas, coordinate the planning and layout of urban and rural infrastructure, accelerate the upgrading of rural infrastructure, and improve the beautiful and livable level of rural areas as a whole.

1. Continue to promote the "Hundred Thousand Projects"

Adhere to a blueprint to the end, continue to promote the "demonstration of 100 villages and renovation of thousands of villages" project, and cultivate a number of rural revitalization models. Formulate and implement five-year actions to improve rural human settlements. We will continue to promote the upgrading of old household toilets in rural areas and carry out the "clearing action" for rural public dry toilets. We will promote the collection and treatment of rural domestic sewage according to local conditions, continue to promote the third three-year pollution control action plan, complete 300 village sewage treatment tasks every year, and comprehensively and effectively treat rural domestic sewage. Promote the classification and treatment of rural domestic waste according to local conditions. Improve the village public lighting facilities, neighborhood road construction, and optimize the layout of rural public parking lots. By 2025, the coverage rate of rural sanitary toilets in the city will be stable at over 99%, the proportion of Class III and above public toilets will reach over 95%, and the sewage treatment rate in rural areas will reach 75%.

2. Fill in the shortcomings of rural public infrastructure

We will implement the rural drinking water safety consolidation and upgrading project, increase investment in the construction of township-level centralized water supply plants and the renovation of village-level water supply facilities, expand the coverage of public water supply, and promote the construction of specialized service system for rural water supply. Consolidate the achievements of "Four Good Rural Roads", carry out the construction of "beautiful countryside Road", implement the "road length system" of rural roads, and further improve the service level of "bus service for every village". Optimize the rural energy structure, transform and upgrade the rural power grid in mountainous areas, achieve full coverage of stable and reliable power supply, and promote the "coal to clean energy" in mountainous villages according to local conditions. Build a digital village, speed up the construction of a comprehensive information service system for agriculture and rural areas, establish an inclusive service mechanism for agriculture-related information, and promote the digitalization of rural management services. By 2025, the rural water supply guarantee rate will remain above 95%, the tap water penetration rate will remain above 99%, and the proportion of medium roads and above in rural roads in the city will remain above 90%.

3. Deepen the construction of beautiful countryside.

In accordance with the requirements of green and low-carbon rural beauty, ecologically livable village beauty, healthy and comfortable life beauty, and harmonious and simple humanistic beauty, beautiful countryside’s construction standards will be further improved, construction contents will be increased, and the construction level will be improved. Organize the demonstration activities of beautiful livable villages and beautiful courtyards, and by 2023, basically complete the task of infrastructure construction in beautiful countryside. Support city sub-centers to build beautiful countryside model area. Implement the quality improvement project of rural housing construction, carry out upgrading and transformation in an orderly manner, preserve the rural characteristics and prevent large-scale demolition and construction. Improve the quality and safety system norms and supervision mechanism of rural housing construction, strive to complete the investigation and rectification of rural housing safety hazards by 2023, and establish a normalized rural housing construction management system.

4. Implement a long-term management and protection mechanism

Improve the long-term management and protection mechanism of rural infrastructure and human settlements with systems, standards, teams, funds and supervision. Clarify the ownership of rural public infrastructure property rights formed by various types of investment at all levels, establish management standards and systems by property owners, implement the responsibility of "who owns the property rights and who will manage it", and incorporate the investment in management and protection of public welfare facilities into the general public finance budget and fully guarantee it. Improve the diversified management and protection mechanism of quasi-operating facilities, and explore the formation mechanism of market-oriented paid prices in industries with conditions. We will improve the four-level linkage inspection and assessment mechanism of rural human settlements, which includes village self-inspection, town inspection, district inspection and city inspection.

(3) Protecting the rural green ecological space

Firmly establish the concept of Lucid waters and lush mountains are invaluable assets, build a vivid demonstration and leading area of the concept of "two mountains", serve the big cities with the suburbs of Beijing with good ecology and beautiful environment, and provide more high-quality ecological products and services for the cities.

1. Clean agricultural production environment

We will do a good job in the prevention and control of agricultural non-point source pollution, promote the reduction of chemical fertilizers and pesticides, strengthen the control of white pollution in farmland, and recycle manure and straw in large-scale farms. By 2025, the utilization rate of chemical fertilizers and pesticides will remain at a relatively high level of 40% and 45%, the comprehensive utilization rate of manure in large-scale farms will reach 95%, crop straw will be basically recycled, and agricultural film will be basically recovered. Construction of "straw-livestock breeding-organic fertilizer" planting and breeding demonstration base and circular agriculture demonstration park, strengthen the pollution prevention of livestock breeding and aquaculture below the scale. Vigorously develop high-efficiency water-saving agriculture and support the construction of the national agricultural green development pioneer zone. We will promote legislation for the prevention and control of soil pollution, establish and improve the monitoring network of cultivated land soil environmental quality, improve the classified management mechanism of cultivated land, and promote remediation and treatment in an orderly manner. By 2025, the safe utilization rate of contaminated cultivated land soil will reach over 95%, and the quality level of cultivated land in the city will be further improved.

2. Building a green village

Intensify the protection of cultivated land, optimize the layout of cultivated land and forest land in pieces and on a large scale in accordance with the principle that arable land is suitable for cultivation and forest is suitable for forest, build a compound ecosystem of farmland and forest, and promote the centralized contiguous layout of cultivated land and permanent basic farmland, with the centralized contiguous scale of more than 1,000 mu accounting for more than 80% of the total. Through typical demonstration, point breakthrough, and surface push, water-saving rural construction will be carried out. We will continue to do a good job in key ecological projects such as demolition and greening in shallow mountainous areas, afforestation of barren hills suitable for forests, and control of sandstorms in Beijing and Tianjin. Strengthen the greening of villages, make forests suitable for forests and gardens suitable for gardens, carry out the construction project of thousands of villages and gardens (forests), build 500 village-head parks and village-head forests around villages and towns, and newly create 250 capital forest villages.

3. Improve the value realization mechanism of ecological products.

We will implement the Regulations on Ecological Protection and Green Development of Ecological Conservation Areas in Beijing, and improve mechanisms such as compensation for ecological protection, pairing and cooperation, and exchange of cadres. Formulate policies to guide and support suitable industries in ecological conservation areas, and guide resource-saving and eco-friendly industrial projects to land in ecological conservation areas; Build an ecological gully region, strengthen planning guidance, improve the construction level, and highlight ecological, social and landscape benefits. Implement the spirit of the important reply from the Supreme Leader General Secretary to the villagers who build and protect Miyun Reservoir, coordinate the relationship between water conservation and enriching the people, and prevent the loss of protecting the ecological environment. Explore the construction of zero-carbon demonstration villages and zero-carbon demonstration parks, promote the development of green and low-carbon cycle in agriculture and rural areas, and contribute to the steady decline of carbon in the city after its peak. Further improve the system of paid use of natural resources, study and compile the evaluation index system of green development, and carry out the value accounting of ecological products.

Five, cultivate civilized rural style

Practice the socialist core values, take the inheritance and development of Chinese excellent traditional culture as the core, promote the balanced development of urban and rural public cultural service system, increase the supply of excellent rural cultural products and services, and boost farmers’ mental outlook.

(A) to strengthen the ideological and moral construction in rural areas

We will continue to promote the construction of spiritual civilization in rural areas, adhere to the people-oriented, peasant-centered, multi-party participation, and constantly improve the level of rural civilization through publicity and guidance, practice and institutional guarantee, laying an ideological and moral foundation for rural revitalization.

1. Practice the socialist core values

Deepen the construction of a civilized practice center in the new era, open up the "last mile" to publicize, educate, care for and serve the masses, and promote the socialist core values to be deeply rooted in the hearts of the people. Highlight the ideological guidance of hot and difficult issues in rural society and reasonably guide social expectations. Give full play to the role of first secretary, party building assistant and volunteer, strengthen emotional communication with farmers, collect public opinion, and do a good job in emotional comfort and humanistic care. Carry out education on the spirit of entrepreneurship and innovation, and guide the masses to actively participate in innovation and entrepreneurship practice.

2. Implement the civic moral construction project.

Carry out roving lectures on model examples, publicize in depth the typical deeds such as model of the times, Beijing model, moral model, the most beautiful people, good people around us, and the most beautiful volunteers, and extensively carry out model learning and practice activities. Strengthen the construction of rural network culture positions, and give full play to the function of "guiding and serving the masses" of the media centers in various districts. Deepen the construction of honesty culture, strengthen farmers’ awareness of social responsibility, rules, collectivity and ownership, and cultivate a good social trend of keeping promises.

3. Carry out rural spiritual civilization creation activities.

We will deepen the activities of establishing civilized villages and towns and civilized families, and carry out typical tree evaluation activities of family civilization such as "learning from the example and taking action", good daughter-in-law, good in-laws and good sisters-in-law, as well as theme activities such as passing on family training, establishing family rules and promoting family style, so as to support good village style and folk customs with good family style. Explore the reward modes such as "rural moral bank", "civilization points" and "volunteer points" to reward advanced models so that the virtuous can have it. Intensify the crackdown on illegal religious activities and overseas infiltration activities in rural areas. Strengthen the publicity and education of building a strong sense of community of the Chinese nation.

(B) the prosperity of rural traditional culture

Based on the rural civilization in the suburbs of Beijing, on the basis of protection and inheritance, we will realize the creative transformation and innovative development of Chinese excellent traditional culture.

1. Inheriting innovative farming culture

Encourage "Jingxi Rice Culture System" and Pinggu "Sisoulou Juglans Juglans Production System" to declare the world’s important agricultural cultural heritage, and support all districts to carry out the excavation, interpretation and utilization of agricultural cultural heritage. We will carry out the construction of facilities that reproduce the development of rural civilization, such as the exhibition room of rural history, the museum of farming culture, the exposition park, the cultural center and the ruins park. Aiming at the leisure needs of rural areas in big cities, we will support all districts to fully tap and make innovative use of farming culture and strengthen the functions of education, health care, landscape and leisure.

2. Excavate and utilize intangible cultural heritage

Promote the revitalization of traditional crafts in rural areas. Further explore, sort out, protect and inherit all kinds of intangible cultural heritage such as traditional place names, operas, skills, restaurants and temple fairs. Discover and protect a number of new intangible cultural heritage projects and promote the construction of intangible cultural heritage resources database. Support the innovative development of rural intangible cultural heritage and promote its active utilization. We will carry out the recording of national representative inheritors, carry out in-depth training programs for non-genetic inheritors, and improve the intergenerational inheritance and development mechanism of intangible heritage. We will create a hometown of folk culture and art in China, promote the pilot work of the Internet to promote the construction of a demonstration base for rural cultural revitalization, strengthen the use of new technologies and new media, and increase the dissemination of outstanding traditional culture and folk culture in rural areas.

3. Protect and develop traditional villages

Implement the Regulations on the Protection of Historical and Cultural Cities in Beijing and the Guiding Opinions on Strengthening the Protection and Development of Traditional Villages. Implement listing protection for municipal traditional villages, set up protection signs, and complete the preparation and approval of municipal traditional village protection planning. In accordance with the planning and technical guidelines for the renovation of traditional villages in the city, the renovation pilot will be carried out according to local conditions. Carry out the compilation of traditional village records and inherit homesickness memories.

(C) Enriching rural cultural life

Improve rural public cultural service facilities, increase the supply of excellent rural cultural products and services, invigorate rural cultural life, provide high-quality spiritual nutrition for farmers, and continuously improve the level of public cultural service system.

1. Improve rural public cultural service facilities.

Improve urban and rural grassroots public cultural facilities and improve the four-level network system of public cultural facilities. Build a public cultural service cloud system, promote the application of new carriers such as interactive Internet TV and mobile digital terminals, and increase the push of public digital cultural resources to rural areas. Carry out cultural activities in the countryside, build a number of mobile "reading stations" and update a number of rural libraries. Make full use of idle land resources around towns and villages to build national fitness venues and facilities. Continue to promote the construction of township cultural and sports activity centers and citizens’ cultural and leisure centers.

2. Increase the supply of public cultural products and services.

Create and launch a number of outstanding rural literary and artistic works, and plan to launch a number of radio, television and online programs that farmers love. Strengthen the construction of public cultural service brands such as "Spark Project of Rural Literary Performance". Set up a "light cavalry" literary squad to carry out "order-based" public cultural services in combination with rural needs.

3 to carry out various forms of mass cultural and sports activities.

Support the grassroots to hold festivals such as China Farmers Harvest Festival, and create a new brand of rural cultural tourism integration shared by urban and rural residents. Guide and support rural self-management culture, and encourage and support literary and artistic creation with local characteristics. Carry out rural cultural activities such as square dance, farmer troupe performance, calligraphy and painting photography creation. Continue to carry out the activities of Beijing Farmers Art Festival. Continue to hold the exhibition week of farmers’ physical fitness in Beijing, and inherit, innovate and develop traditional folk sports.

VI. Building a Good Governance Village

Establish and improve a modern rural social governance system with the leadership of the Party committee, government responsibility, democratic consultation, social coordination, public participation, legal protection and scientific and technological support, and a rural social governance system that combines autonomy, rule of law and rule of virtue to improve the level of good governance in rural areas.

(A) to strengthen the leading role of rural grassroots party organizations

Highlight the political and organizational functions of rural grassroots party organizations, and build rural grassroots party organizations into a strong fighting fortress that leads rural revitalization.

1. Improve the system and mechanism of rural governance under the leadership of the Party.

Fully implement the hard tasks of the regulations on the work of rural grassroots organizations and strengthen the standardization of rural grassroots party organizations. Complete the change of the village "two committees" on schedule, actively promote the secretary of the village party organization to serve as the director of the village Committee through legal procedures, and promote the cross-appointment of members of the village "two committees" team. We will fully implement the working mechanism that the disciplinary inspection committee member of the village party organization concurrently serves as the director of supervision committee. Implement the classification and upgrading plan of village-level organizations and normalize the rectification of weak and scattered village party organizations. We will continue to deepen party building and lead the reform of "whistling in the streets and townships and reporting to departments", improve the mechanism of "handling complaints immediately", and continuously improve the settlement rate and satisfaction rate of farmers’ demands. In adjusting and optimizing the setting of administrative divisions, it is necessary to realize the synchronous adjustment and optimization of the setting of rural grass-roots party organizations, and steadily and prudently promote the withdrawal of villages and the establishment of houses. Carry out pilot work to promote the revitalization of red rural organizations and build red beautiful villages.

2. Building a contingent of high-quality rural grassroots cadres.

Select and match the "two committees" of the village, highlight "double good and double strong", and realize "one drop and one rise" in age and education. Implement the "Touyan Project" and strengthen the construction of village party organization leaders. We will implement the long-term mechanism of district-level filing management of village party secretaries and joint examination of village cadres’ qualifications, do a good job in the demonstration training of village party branch secretaries at the municipal level, guide all districts to carry out the rotation training of village "two committees" cadres, and improve and perfect the work chain of "selecting and using". We will steadily raise the basic remuneration of village cadres and the standard of office expenses for village-level organizations. Adhere to the "four batches" selection method, and the number of village-level reserve talents in the city remains around 8,000. Do a good job in the junior college education of village management specialty and explore the village-level reserve training model. Establish and improve a long-term mechanism for selecting the first secretary, strengthen daily management and support, and give full play to the role of the first secretary.

3. Give play to party member’s vanguard and exemplary role in rural governance.

Implementation of rural party member demonstration project, pay attention to the development of rural youth party member and highly educated party member, to ensure that the proportion of party member under the age of 35 remains basically stable, and the proportion of rural party member with college education has steadily increased. Implement Do not forget your initiative mind, keep in mind the mission system, and consolidate and deepen the achievements of thematic education. We will deepen the activities of street leaders in party member, making promises and keeping promises, setting posts and responsibilities, and volunteering, further refine the system of village cadres going to villages and contacting households in party member, and promote party member to take the lead in demonstrating rural governance and drive the masses to participate in an all-round way. Guide party member to take responsibility in the service guarantee of major events.

(B) to build a modern rural governance system

Improve and innovate the construction of rural governance system with the integration of "three governance" led by party building, insist on increasing vitality with autonomy, strengthening protection with the rule of law, promoting healthy trends with morality, and promote the modernization of rural governance system and governance capacity.

1. Deepen the practice of villagers’ autonomy.

We will improve the system of rural grass-roots mass autonomous organizations and standardize the establishment of sub-committees of villagers’ committees such as co-construction and co-governance, public health, environmental property (land management) and so on. Further standardize the operation of the village-level system of "four discussions, first trial and two openness", implement the village-level system of "three affairs openness", incorporate rural land management into the important content of village-level democratic management and supervision, and encourage the use of information technology to achieve online and offline full disclosure. Governance of village-level organizations to undertake more administrative affairs, inspection and evaluation items and other issues, reduce the burden on village-level organizations. Standardize all kinds of work accounts and all kinds of seal certification matters at the village level. Carry out demonstration and promotion of village rules and regulations to ensure that the household registration rate and awareness rate are 100% and 100%. Promote the use of the points system in rural governance, guide farmers to actively participate in public affairs, and give play to the role of villagers’ autonomy.

2. Promote the construction of rural areas ruled by law.

Improve the agricultural and rural policies and regulations system, and strengthen publicity and education on law popularization. Promote the construction of demonstration villages of democracy and the rule of law. By 2025, the coverage rate of demonstration villages of democracy and the rule of law in the city will reach over 30%. Strengthen the construction of township judicial offices and public legal service stations, strive for the standardized proportion of township judicial offices in the city to increase year by year, and the completion rate of public legal service stations will reach 100%. Realize that each village is equipped with one village legal adviser. Promote the extension and sinking of administrative law enforcement authority and power to towns, integrate existing law enforcement forces and resources, and form a unified township comprehensive administrative law enforcement team. We will further promote the construction of safe rural areas, establish and improve the normalization mechanism for eliminating evils in rural areas, intensify the crackdown on illegal religious activities and cult activities in rural areas according to law, stop using religions and cults to interfere in rural public affairs, and incorporate related work into the assessment system for the construction of a safe Beijing. Establish and improve the prevention and control system of social security in rural areas and build a "discerning project" in rural areas. Deepen the construction of clean rural areas, compile a list of village-level "small and micro" powers, and standardize the operation of village-level powers.

3. Improve the level of rural rule of virtue

Inherit the excellent traditional culture in rural areas, and carry forward the traditional virtues such as respecting morality and being kind, valuing righteousness and keeping promises, caring for the old and loving relatives, and helping the poor. We will rectify bad customs such as weddings and funerals in rural areas, high bride price, extravagance and waste, and thick burial and thin support. Encourage villages to set up red and white councils to promote the change of customs. Explore the establishment of a reporting system for weddings and funerals of cadres in rural party member, and strengthen discipline. Extensively carry out tree selection activities such as the most beautiful neighborhood, good people around you, good teenagers in the new era, and finding the most beautiful family. We will carry out the public service action of Xinxiang Xian, and actively promote all kinds of social welfare organizations and Xinxiang Xian to participate in rural governance in an orderly manner.

(C) improve the efficiency of rural governance

Do a good job in grass-roots government services, innovate grass-roots governance methods, improve social mobilization ability, and build a new pattern of rural social governance.

1. Strengthen the capacity building of serving agriculture in towns and villages.

Improve the level of grass-roots government services, promote the construction of an integrated online government service platform, promote "one-line operation", provide "one-door handling" and "one-stop service", and realize "running at most once". Standardize the entity platform of government services, and set up a comprehensive government service center in each township to provide government services such as employment, old-age support, medical and health care, housing security and social security for the masses. Due to the adaptation of villages, government service stations are set up by means of "one station, one village" and "one station, multiple villages" to create a rural half-hour convenience service circle. Promote the construction of township social work service stations. Build towns and villages into rural governance centers, rural service centers and rural economic centers, so that towns and villages will become the leading players in promoting rural revitalization.

2. Improve the informatization level of rural governance.

Actively adapt to the normalization requirements of epidemic prevention and control, and promote the construction of smart and safe villages and the normalization of joint prevention and control. Promote the intelligence and wisdom of rural governance, build a city-wide rural governance basic information database with people, land, things and organizations as the core, and build an interoperable and shared rural governance service management application platform. Promote the extension of "internet plus community" to rural areas, explore a new model of "Party building in internet plus", and gradually improve the level of informationization of village-level government services. Use new media to guide residents to have close daily contacts and participate in public affairs, and realize networked community governance and service innovation.

3. Promote the extensive participation of social forces.

We will implement the Party Building Coordination Committee, establish a joint meeting system for Party building work, and promote the expansion of the work content of the Party Building Coordination Committee to all areas of grassroots governance. Innovate and develop mass prevention and treatment, improve management mechanisms such as level prevention and control, star rating, public welfare feedback, and insurance protection, and mobilize more forces to participate in grassroots governance. We will extensively carry out voluntary service activities, mobilize multiple subjects to actively participate in rural governance, and form a good atmosphere of being good neighbors, partners and helping each other.

VII. Ensuring the People’s Livelihood in Rural Areas

Taking the protection and improvement of rural people’s livelihood as the priority direction, focusing on "seven haves" and "five natures", we will speed up the filling of shortcomings in rural basic public services, promote the equalization of urban and rural public services, protect and improve rural people’s livelihood at a higher level, and constantly satisfy the people’s yearning for a better life.

(A) the income of farmers is growing faster than that of urban residents.